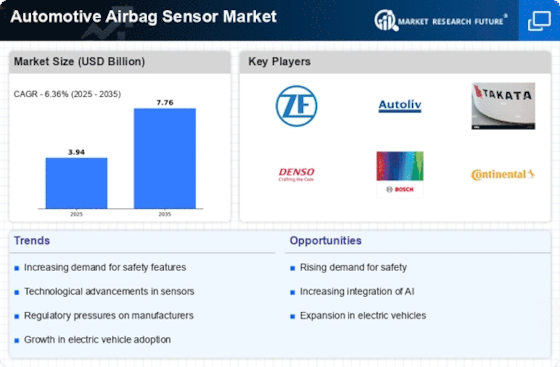

Leading market players are investing heavily in research and development in order to expand their product lines, which will help the Automotive Airbag Sensor Market, grow even more. Market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, Automotive Airbag Sensor industry must offer cost-effective items.

Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the global Automotive Airbag Sensor industry to benefit clients and increase the market sector. In recent years, the Automotive Airbag Sensor industry has offered some of the most significant advantages to medicine. Major players in the Automotive Airbag Sensor Market, including Autoliv Inc., Continental AG, Denso Corporation, Freescale Semiconductor, Key Safety Systems, Mitsubishi Electric Co., Ltd., Robert Bosch Corporation, Takata Corporation, Toyoda Gosei, and TRW Automotive, are attempting to increase market demand by investing in research and development operations.

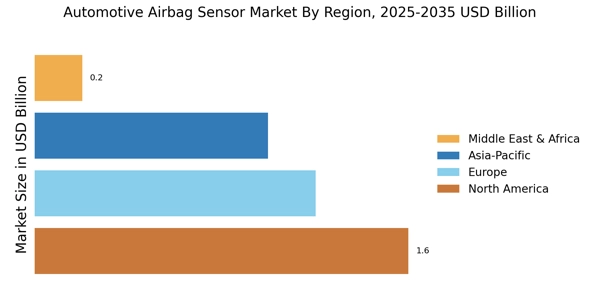

The automobile firm Continental AG (Continental) produces and sells brake systems, powertrain and chassis systems, vehicle electronics, instruments, infotainment solutions, tires, and technical elastomers. For a variety of customers, including those who own passenger cars, trucks, buses, and vehicles used on construction sites as well as special vehicles, bicycles, and motorbikes, the company also sells tires and offers tire repair services. Under the Elektrobit, VDO, Uniroyal, Phoenix, Matador, and other brands, Continental markets its products. Customers from Asia, Europe, North America, and other continents are catered to by the company.

North America, Africa, South America, Europe, Asia, and Australia are the continents where it has operational facilities. The headquarters of Continental are in Hannover, Niedersachsen, Germany. The production of one million Airbag Control Units (ACUs) at Continental's Bengaluru factory accomplished a significant milestone in December 2021.

The company Mitsubishi Electric Corp. creates, produces, and sells electrical and electronic equipment. Among the products offered by the company are turbine generators, nuclear power plant, and power electronics equipment, as well as motors, transformers, circuit breakers, gas-insulated switchgear, switch control, and display devices. Additionally, it offers building security and management systems, escalators, elevators, electrical equipment for locomotives and rolling stock, transmission and distribution systems, and more. The business offers a variety of services, including logistics, finance, real estate, and advertising.

Mitsubishi Electric provides services to the information processing and communications, satellite communications, consumer electronics, industrial technology, construction equipment, energy, and transportation industries. The business conducts business throughout the CIS, the Americas, the Asia-Pacific, Europe, Middle East, and Africa. The headquarters of Mitsubishi Electric are located in Chiyoda-Ku, Tokyo, Japan. Mitsubishi Electric stated in October 2019 that a new car component manufacturing would be established in Gujarat.