Growth of Electric Vehicle Market

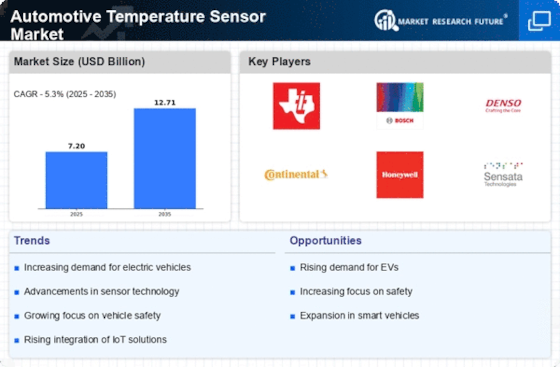

The Automotive Temperature Sensor Market is significantly influenced by the rapid growth of the electric vehicle (EV) market. As manufacturers pivot towards electric mobility, the need for precise temperature management in battery systems becomes increasingly critical. Temperature sensors are essential for monitoring battery health and performance, ensuring safety and efficiency. Recent data indicates that the EV market is expected to witness a compound annual growth rate of approximately 30% over the next decade. This transition to electric vehicles not only necessitates the integration of advanced temperature sensors but also presents opportunities for innovation in sensor technology, thereby propelling the automotive temperature sensor market forward.

Increasing Focus on Vehicle Safety Standards

The Automotive Temperature Sensor Market is being propelled by an increasing focus on vehicle safety standards. Regulatory bodies are implementing stringent safety regulations that require manufacturers to equip vehicles with advanced monitoring systems, including temperature sensors. These sensors are vital for preventing overheating and ensuring the safe operation of critical components. As safety regulations become more rigorous, the demand for reliable automotive temperature sensors is expected to grow. Recent reports suggest that the automotive safety market is projected to expand at a compound annual growth rate of around 8% in the next few years, indicating a robust opportunity for temperature sensor manufacturers.

Technological Advancements in Sensor Technology

The Automotive Temperature Sensor Market is poised for growth due to ongoing technological advancements in sensor technology. Innovations such as wireless sensors and smart temperature monitoring systems are enhancing the capabilities of automotive temperature sensors. These advancements allow for real-time data transmission and improved accuracy, which are crucial for modern vehicles. The market for automotive sensors is projected to reach USD 50 billion by 2026, with temperature sensors accounting for a significant share. As manufacturers increasingly adopt these advanced technologies, the demand for sophisticated temperature sensors is likely to rise, further driving the automotive temperature sensor market.

Rising Consumer Awareness of Vehicle Performance

The Automotive Temperature Sensor Market is benefiting from rising consumer awareness regarding vehicle performance and maintenance. As consumers become more informed about the importance of temperature management in vehicles, they are increasingly seeking vehicles equipped with advanced temperature monitoring systems. This trend is likely to drive demand for automotive temperature sensors, as they play a crucial role in maintaining optimal engine performance and fuel efficiency. Market analysis indicates that the automotive aftermarket is expected to grow significantly, with temperature sensors being a key component in enhancing vehicle performance. This growing consumer awareness is likely to create a favorable environment for the automotive temperature sensor market.

Rising Demand for Advanced Driver Assistance Systems

The Automotive Temperature Sensor Market is experiencing a notable surge in demand for advanced driver assistance systems (ADAS). These systems rely heavily on accurate temperature readings to ensure optimal performance and safety. As vehicles become increasingly equipped with features such as adaptive cruise control and lane-keeping assistance, the need for reliable temperature sensors becomes paramount. According to industry estimates, the ADAS market is projected to grow at a compound annual growth rate of over 20% in the coming years. This growth is likely to drive the demand for automotive temperature sensors, as they play a critical role in monitoring engine and cabin temperatures, thereby enhancing the overall functionality of these advanced systems.