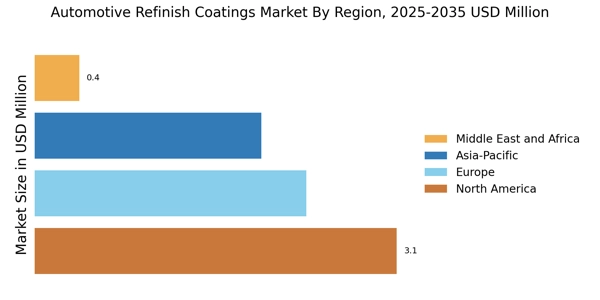

North America: Mature Refinish Market

North America represents a mature yet dynamic market for automotive refinish coatings, accounting for a significant share of global demand. The region’s growth is driven by a large, aging vehicle fleet, frequent collision repairs, and a well-established aftermarket ecosystem. Stringent environmental regulations have accelerated the adoption of low-VOC, waterborne, and sustainable coatings, prompting suppliers to innovate while ensuring compliance. The U.S. leads the market, followed by Canada, with major players investing in high-performance, fast-curing, and durable coating solutions. Technological adoption, including AI-enabled color matching and automated application systems, enhances efficiency in body shops. Overall, North America is characterized by steady demand, regulatory pressure, and innovation-driven growth.

Europe: Regulatory and Technology-Driven Market

Europe holds a significant and steadily growing share of the automotive refinish coatings market. Strong automotive heritage, a large vehicle parc, and well-developed aftermarket networks drive demand across countries such as Germany, France, Italy, and the UK. Strict VOC regulations and environmental standards are accelerating the shift to low-emission and waterborne coatings. Suppliers are focusing on sustainable solutions, fast-curing technologies, and AI-driven color matching to improve efficiency and finish quality. Rising vehicle ownership, high repair activity, and consumer preference for premium and eco-friendly finishes underpin consistent market expansion, making Europe a regulatory and technology-driven refinish market.

Asia-Pacific: Largest and Fastest-Growing Market

Asia-Pacific is the largest and fastest-growing automotive refinish coatings market globally, driven by rapid urbanization, increasing vehicle ownership, and a robust aftermarket repair ecosystem. China and India dominate demand due to expansive vehicle fleets and rising middle-class vehicle purchases. Environmental regulations and consumer preferences are encouraging the adoption of low-VOC and waterborne coatings, while cost sensitivity and skills gaps pose challenges. Technological upgrades, customization trends, and demand for high-performance, durable finishes further stimulate market growth. The region’s combination of fleet expansion, regulatory pressure, and aftermarket development positions Asia-Pacific as a dynamic and rapidly expanding market.

Latin America: Emerging Refinish Market

Latin America represents an emerging automotive refinish coatings market, characterized by growing vehicle ownership, rising repair activity, and increasing consumer focus on vehicle maintenance and aesthetics. Brazil, Mexico, and Argentina are key markets, with Brazil leading both in volume and growth prospects. Low-VOC and waterborne coatings are gaining traction, driven by sustainability trends, while economic volatility and infrastructure variability pose challenges. Expanding insurance coverage and investments by global suppliers support continued market growth, positioning Latin America as a steadily expanding, opportunity-rich region.

Middle East and Africa: Emerging Market Frontier

The Middle East and Africa (MEA) automotive refinish coatings sector is an emerging but promising market, supported by rising vehicle ownership, expanding aftermarket infrastructure, and growing demand for maintenance and aesthetic refinishing services. Key markets include Saudi Arabia, UAE, and South Africa, where investments in high-performance, climate-resistant coatings are increasing. Adoption of eco-friendly, low-VOC formulations is progressing, though unevenly. As the region transitions from informal practices to standardized, performance-driven solutions, MEA is positioned for steady growth and emerging market potential in automotive refinish coatings.