Growth of Electric and Hybrid Vehicles

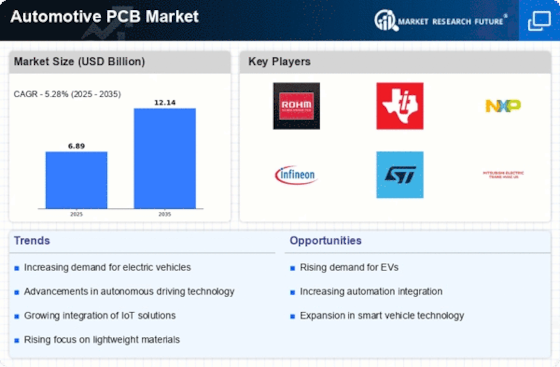

The Automotive PCB Market is significantly impacted by the growth of electric and hybrid vehicles. As the automotive sector shifts towards more sustainable energy solutions, the demand for specialized PCBs that can handle the unique requirements of electric drivetrains is increasing. These vehicles require PCBs that can manage high voltage and current levels, as well as support various battery management systems. The electric vehicle market is anticipated to expand rapidly, with projections indicating that electric vehicles could account for over 30% of total vehicle sales by 2030. This transition necessitates the development of innovative PCB solutions tailored to the specific needs of electric and hybrid vehicles, thereby driving growth in the Automotive PCB Market.

Rising Demand for Lightweight Materials

The Automotive PCB Market is experiencing a shift towards the use of lightweight materials in vehicle manufacturing. As automakers strive to improve fuel efficiency and reduce emissions, the demand for lightweight components, including PCBs, is on the rise. Lightweight PCBs can contribute to overall vehicle weight reduction, which is crucial for enhancing performance and efficiency. The trend towards lightweight materials is expected to gain momentum, with projections indicating that the market for lightweight automotive components could grow significantly in the next few years. This shift presents a unique opportunity for the Automotive PCB Market, as manufacturers are challenged to innovate and produce PCBs that are not only lightweight but also maintain high performance and reliability.

Increased Connectivity and IoT Integration

The Automotive PCB Market is also being driven by the increasing connectivity and integration of Internet of Things (IoT) technologies in vehicles. Modern automobiles are becoming more connected, with features such as real-time traffic updates, remote diagnostics, and over-the-air software updates. This trend necessitates the use of advanced PCBs that can support high-speed data transmission and robust communication protocols. The market for connected vehicles is expected to grow substantially, with estimates suggesting that the number of connected cars could reach over 500 million by 2025. This proliferation of connectivity in vehicles creates a substantial opportunity for the Automotive PCB Market, as manufacturers seek to develop PCBs that can accommodate the growing demand for integrated technology.

Regulatory Compliance and Safety Standards

The Automotive PCB Market is influenced by stringent regulatory compliance and safety standards that govern vehicle manufacturing. As governments worldwide implement more rigorous safety regulations, automotive manufacturers are compelled to enhance the reliability and performance of their electronic systems. This, in turn, drives the demand for high-quality PCBs that meet these evolving standards. For instance, regulations concerning electromagnetic compatibility (EMC) and functional safety are becoming increasingly critical. The need for PCBs that can withstand harsh automotive environments while ensuring compliance with safety standards is likely to propel growth in the Automotive PCB Market. Manufacturers are thus focusing on developing PCBs that not only meet regulatory requirements but also enhance overall vehicle safety.

Integration of Advanced Driver Assistance Systems

The Automotive PCB Market is experiencing a notable surge due to the integration of advanced driver assistance systems (ADAS). These systems, which enhance vehicle safety and driving experience, rely heavily on sophisticated printed circuit boards (PCBs) for their functionality. As vehicles increasingly incorporate features such as adaptive cruise control, lane-keeping assistance, and automated parking, the demand for high-performance PCBs is expected to rise. In fact, the market for ADAS is projected to grow at a compound annual growth rate (CAGR) of over 20% in the coming years. This growth directly influences the Automotive PCB Market, as manufacturers strive to develop PCBs that can support the complex electronic systems required for these advanced features.