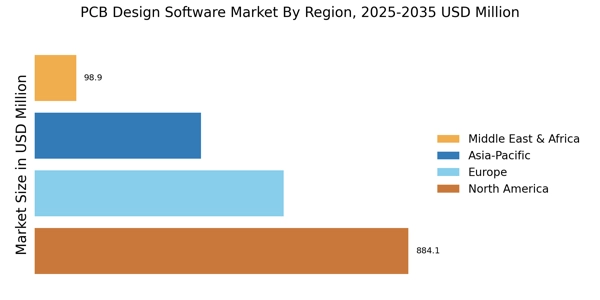

By Region, the study segments the market into North America, Europe, Asia-Pacific, Middle East & Africa, and South America. Throughout the forecast period, the North American PCB Design Software Market is expected to be dominant. This region's growth is expected to be spearheaded by economies such as Canada and the United States. North America is the dominating the global semiconductor market in terms of chip design and semiconductor R&D. In chip design, the major success factors in USA are access to highly skilled engineering human source and a strong innovation ecosystem, leading by universities.

For instance,10 out of the top 20 semiconductor design companies (comprising both fabless and IDMs (Integrated Device Manufacturers)), along with 4 of the top 5 EDA and core IP enterprises by 2019 revenue, are headquartered in the US.

Asia-Pacific is the fastest growing region. The increase in the scope of R&D expenditures in the semiconductor industry by various countries and growing purchaser surmise and flourish demand of consumer electronics are driving the growth of the EDA market in the Asia Pacific region. The positive PCB manufacturing in the region have significant market share, heavy demand of electronics products in emerging countries and government supports to provide favorable environment for semiconductor industry is driving the growth of PCB design software market in Asia-pacific.

Europe is expected to register a significantly rapid revenue growth rate during the forecast period owing to increasing implementation of PCB design software in the electronics sector. Rising demand of PCB design software in the field of telecommunications is also boosting market growth. Germany is the most important actor in the EDA European market, followed by UK. The PCB design market share is concentrated among a few leading EDA vendors in North America and Europe.

Even in the case of the European industry, electronic components and systems are strong supporters of the development of innovation and productivity in the entire European market and the PCB manufacturers are mainly involved in producing high end PCBs with sophisticated design, but lack in low and medium end PCBs as market is acquired by Asian countries.

In case of the Middle East and Africa, most of the electronics equipment demand is fulfilled by import of Asia-pacific region due to lack of financial and human resources, political unrest, lack of investment and high cost in developing required infrastructure. Still due to presence of number of emerging countries such as Nigeria, South Africa and Israel, there is steady growth in the demand of PCBs in this region which is expected to imitate and propel the growth of PCB design software market in this region.

FIGURE 3: PCB DESIGN SOFTWARE MARKET VALUE BY REGION 2022 VS 2032 (USD Million)

Further, the countries considered in the scope of the PCB Design Software Market are the US, Canada, Mexico, UK, Germany, France, Italy, Spain, Switzerland, Austria, Belgium, Denmark, Finland, Greece, Hungary, Italy, Luxembourg, Netherlands, Norway, Poland, Portugal, Slovakia, Sweden, Romania, Ireland, China, Japan, Singapore, Malaysia, Indonesia, Philippines, South Korea, Hong Kong, Macau, Singapore, Brunei, India, Australia & New Zealand, South Africa, Egypt, Nigeria, Saudi Arabia, Qatar, United Arab Emirates, Bahrain, Kuwait, and Oman, Brazil, Argentina, Chile, and others.