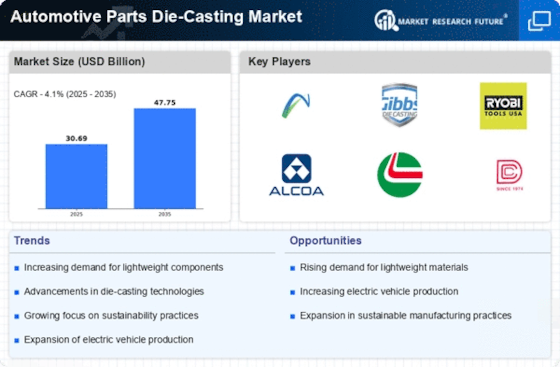

Growth of Electric Vehicle Production

The surge in electric vehicle (EV) production is significantly influencing the Automotive Parts Die-Casting Market. As automakers pivot towards electrification, the demand for specialized components, such as battery housings and structural parts, is increasing. Die-casting processes are particularly advantageous for producing complex shapes and lightweight structures essential for EVs. Reports indicate that the EV market is expected to grow at a compound annual growth rate (CAGR) of over 20% in the coming years. This growth is likely to drive the demand for die-cast parts, as manufacturers seek to optimize performance and efficiency in electric vehicles, thereby bolstering the Automotive Parts Die-Casting Market.

Rising Demand for Lightweight Materials

The Automotive Parts Die-Casting Market is experiencing a notable shift towards lightweight materials, driven by the automotive sector's need for fuel efficiency and performance enhancement. As manufacturers strive to reduce vehicle weight, die-casting processes are increasingly utilized to produce lightweight components. This trend is underscored by the fact that lightweight materials can lead to a reduction in fuel consumption by approximately 10 to 15%. Consequently, the demand for aluminum and magnesium die-cast parts is on the rise, as these materials offer a favorable strength-to-weight ratio. The automotive industry is projected to continue this trajectory, with lightweight components becoming a standard requirement in vehicle design, thereby propelling the growth of the Automotive Parts Die-Casting Market.

Technological Innovations in Die-Casting

Technological advancements are playing a pivotal role in shaping the Automotive Parts Die-Casting Market. Innovations such as improved die designs, enhanced automation, and advanced materials are streamlining production processes and increasing efficiency. For instance, the introduction of 3D printing technology in die-making has reduced lead times and costs, allowing manufacturers to respond swiftly to market demands. Furthermore, the integration of Industry 4.0 principles, including IoT and AI, is optimizing production lines, leading to higher precision and reduced waste. As these technologies continue to evolve, they are likely to enhance the competitiveness of die-casting manufacturers, thereby fostering growth within the Automotive Parts Die-Casting Market.

Regulatory Compliance and Safety Standards

The Automotive Parts Die-Casting Market is also being shaped by stringent regulatory compliance and safety standards. Governments worldwide are implementing regulations aimed at enhancing vehicle safety and reducing emissions. These regulations necessitate the use of high-quality, durable materials in automotive components, which die-casting processes can effectively provide. As manufacturers adapt to these evolving standards, the demand for die-cast parts that meet regulatory requirements is expected to rise. This trend not only ensures compliance but also enhances the overall safety and reliability of vehicles, thereby driving growth in the Automotive Parts Die-Casting Market.

Increasing Investment in Automotive Manufacturing

Investment in automotive manufacturing is a crucial driver for the Automotive Parts Die-Casting Market. As automotive companies expand their production capabilities, there is a corresponding increase in the demand for die-cast components. This investment is often directed towards modernizing facilities and adopting advanced manufacturing technologies, which enhance production efficiency and product quality. Reports suggest that the automotive manufacturing sector is projected to witness substantial capital inflows, particularly in emerging markets. This influx of investment is likely to stimulate the demand for die-casting services, thereby propelling the growth of the Automotive Parts Die-Casting Market.