Growth of the Electric Vehicle Market

The automotive parts-die-casting market is poised for growth due to the rapid expansion of the electric vehicle (EV) market. As EV adoption accelerates, manufacturers are increasingly utilizing die-casting techniques to produce lightweight and efficient components. The U.S. government has set ambitious targets for EV sales, aiming for 50% of all new vehicle sales to be electric by 2030. This transition necessitates the development of specialized components, such as battery housings and structural parts, which can be efficiently produced through die-casting. Consequently, the automotive parts-die-casting market is likely to benefit from this trend, with an expected increase in demand for innovative die-cast solutions tailored for electric vehicles.

Increasing Demand for Fuel Efficiency

The automotive parts-die-casting market is experiencing a notable surge in demand driven by the automotive industry's focus on fuel efficiency. As consumers increasingly prioritize fuel economy, manufacturers are compelled to adopt lightweight materials and advanced manufacturing techniques. This shift is evident in the growing use of die-cast aluminum components, which can reduce vehicle weight by up to 30%. The U.S. automotive sector aims to meet stringent fuel economy standards, which are projected to reach an average of 54.5 mpg by 2025. Consequently, the automotive parts-die-casting market is likely to expand as automakers seek innovative solutions to enhance vehicle performance while adhering to regulatory requirements.

Technological Advancements in Die-Casting

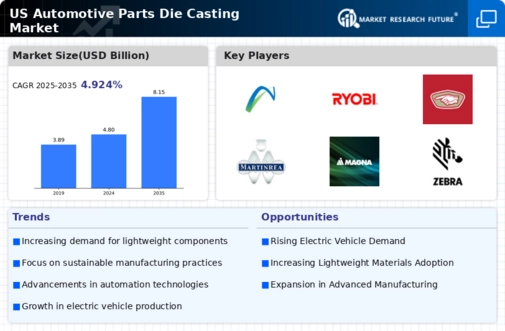

Technological innovations are significantly influencing the automotive parts-die-casting market. The introduction of advanced die-casting techniques, such as high-pressure die-casting and vacuum die-casting, enhances the precision and quality of components. These advancements allow for the production of complex geometries and thinner walls, which are essential for modern automotive designs. Furthermore, the market is witnessing a shift towards automation in die-casting processes, which can improve production efficiency and reduce labor costs. As manufacturers increasingly adopt these technologies, the automotive parts-die-casting market is expected to grow, with projections indicating a compound annual growth rate (CAGR) of approximately 5% over the next five years.

Regulatory Compliance and Safety Standards

The automotive parts-die-casting market is significantly impacted by stringent regulatory compliance and safety standards imposed by government agencies. In the U.S., regulations regarding emissions and safety are becoming increasingly rigorous, compelling manufacturers to innovate and adapt their production processes. The National Highway Traffic Safety Administration (NHTSA) has set forth guidelines that necessitate the use of high-quality materials and components to ensure vehicle safety. This regulatory landscape drives demand for die-cast parts that meet these standards, thereby fostering growth in the automotive parts-die-casting market. As a result, manufacturers are likely to invest in advanced die-casting technologies to comply with these evolving regulations.

Rising Consumer Preferences for Customization

Consumer preferences are shifting towards greater vehicle customization, which is influencing the automotive parts-die-casting market. As buyers seek unique features and personalized designs, manufacturers are compelled to offer a wider range of options. Die-casting allows for the production of intricate designs and custom components that cater to individual tastes. This trend is particularly evident in the luxury and performance vehicle segments, where customization is a key selling point. The automotive parts-die-casting market is likely to expand as manufacturers invest in flexible production capabilities to meet these evolving consumer demands, potentially leading to an increase in market share.