Market Trends

Key Emerging Trends in the Automotive Motor Oil Market

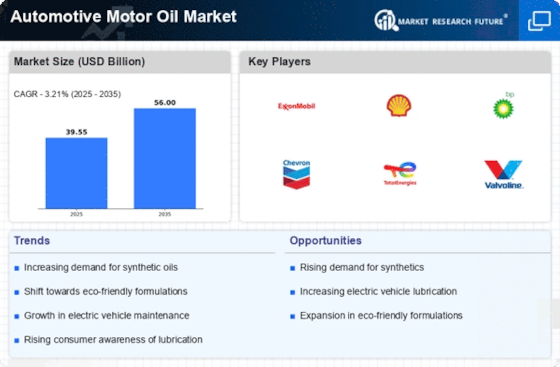

Rapid changes in automotive motor oil sector markets due to evolving customer preferences, technology improvements and other factors such as global government policies on climate change mitigation. Among the significant trends at present is increasing demand for synthetic oils. Synthetic oils, known for their excellent performance characteristics and long life spans, have become more popular with automobile owners as they grow more environmentally conscious and fuel efficient. Moreover there is also a trend among automakers who recommend synthetic oils to enhance fuel efficiency and meet stricter emission standards.

The next noticeable trend is an increasing focus on electric vehicles (EVs) as well as hybrid cars. In the future, this might result in reduced need for traditional engine oils because worldwide auto industry will be moving towards cleaner greener transportation means. Electric cars require minimal amount of lubrication as opposed to conventional automobiles thus calling for distinctive types of lubricants. As such, manufacturers are exploring new formulations that can address specific requirements of electric and hybrid vehicle engines thereby opening up new opportunities for growth via innovations in motor oil industry.

Moreover, the market is placing more emphasis on the protection of engines and durability as a major driver. This has forced consumers to go for high quality motor oils that make vehicles last longer and work better. Consequently, the lines of motor oil products are becoming more specialized because they no longer serve only as lubricants but also reduce friction losses, improve fuel economy and extend change intervals.

Aftermarket demand is increasingly characterized by a growing number of cars on the road for regular maintenance purposes. While they still want their car to last longer, customers have become proactive; hence there has been a shift towards after-market products with particular performance specifications like vehicle-specific grades of engine oil. In such developing auto markets as in Asia-Pacific, this trend is highly observable thus creating attractive business opportunities for manufacturers of motor oils.

Leave a Comment