Market Analysis

In-depth Analysis of Automotive Motor Oil Market Industry Landscape

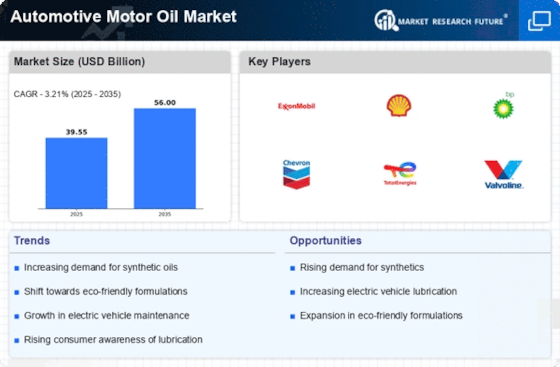

The automotive motor oil sector is one of the most dynamic and rapidly changing industries that highly impacts performance and lifespan of auto engines. Such forces include technological advancements, regulations modifications, consumer preferences including macroeconomic conditions globally among others shaping dynamics at play in this sector.

Technological advancements have a big influence on the dynamics in the field of automotive engine oil. Due to the changing face of engine technology, manufacturers are still producing high-end oils for contemporary advanced engines. This advancement is not only responsible for enhancing engine efficiency but also associated with reduced fuel consumption and emission levels. The situation forces vehicle makers who want to align their products with stringent environmental standards to look for more advanced motor oils hence leading to greener solutions or sustainable development in market dynamics within this area. The automotive motor oil market is also affected by regulatory changes such as; fuel efficiency regulations and stricter emissions standards enacted by governments worldwide in response to environmental concerns. Consequently, there has also been a change in the kind of motor oils being manufactured favoring those that lower emittance levels and improve fuel consumption as well. In this regard, manufacturers need to develop products that comply with the emerging regulatory requirements so as to ensure sustainability of their operations and long-term development of this industry.

Among other factors, changes in consumer choices are some of the drivers behind dynamics witnessed in automotive motor oil market. Demand for engines capable of self-protection while conforming to sustainable and ethical practices has gone up due an increased consciousness regarding environmental issues from more customers who mind about car performance. Therefore, firms should be able to change their offerings in order to meet these needs of green consumers who are demanding that corporations adopt socially responsible practices. This shift from a production-oriented approach to consumer-oriented one has led companies re-aligning their strategies towards making more environment-friendly products.

Motor oil dynamics can be greatly influenced by global economy. Vehicle sales, maintenance activities plus total customer spending on car parts all get directly affected when economic changes take effect. Hence during periods of hard times such as depression or recession when money becomes scarce people can easily switch into cheaper alternatives thus shifting these dynamic toward economical ones . Conversely, when businesses are thriving there is usually high demand for costly lubricants and additives which marks a deviation from the normal market dynamics to specialty products.

Leave a Comment