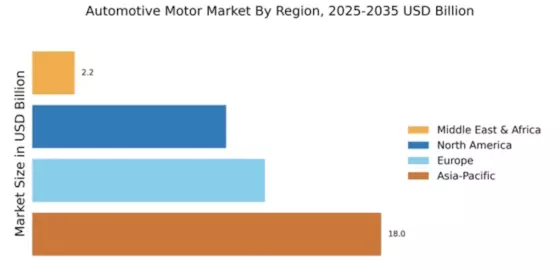

North America : Established Automotive Market

The North American automotive motor market is projected to reach $10.0 billion by December 2025, driven by increasing consumer demand for electric vehicles (EVs) and stringent emissions regulations. The region's automotive sector is bolstered by government incentives aimed at promoting sustainable transportation solutions. Additionally, advancements in technology and manufacturing processes are expected to enhance market growth, making it a pivotal area for automotive innovation.

Leading countries in this region include the United States and Canada, where major automotive manufacturers like General Motors and Ford are headquartered. The competitive landscape is characterized by a mix of established players and emerging startups focusing on EV technology. Key players such as Toyota and Honda are also expanding their presence, contributing to a dynamic market environment that fosters innovation and competition.

Europe : Innovative Automotive Hub

Europe's automotive motor market is anticipated to reach €12.0 billion by December 2025, driven by a strong focus on sustainability and innovation. The European Union's stringent regulations on emissions and fuel efficiency are significant catalysts for growth, pushing manufacturers to invest in advanced technologies. The shift towards electric and hybrid vehicles is reshaping the market landscape, with increasing consumer acceptance and government support.

Germany, France, and the UK are leading countries in this region, hosting major automotive players like Volkswagen, BMW, and Daimler. The competitive landscape is marked by a strong emphasis on R&D, with companies investing heavily in electric mobility and autonomous driving technologies. The presence of key players ensures a robust market environment, fostering collaboration and innovation across the sector.

Asia-Pacific : Emerging Powerhouse in Automotive

The Asia-Pacific automotive motor market is projected to reach $18.0 billion by December 2025, making it the largest regional market. This growth is fueled by rising disposable incomes, urbanization, and a growing middle class, leading to increased vehicle ownership. Additionally, government initiatives promoting electric vehicles and infrastructure development are significant growth drivers, positioning the region as a leader in automotive innovation.

Countries like China, Japan, and South Korea are at the forefront, with major manufacturers such as Toyota, Honda, and Hyundai driving market dynamics. The competitive landscape is characterized by rapid technological advancements and a strong focus on electric and hybrid vehicles. The presence of key players ensures a vibrant market, with ongoing investments in R&D and partnerships to enhance product offerings and meet consumer demands.

Middle East and Africa : Emerging Automotive Frontier

The Middle East and Africa automotive motor market is expected to reach $2.18 billion by December 2025, driven by increasing urbanization and a growing demand for personal vehicles. The region's automotive sector is supported by government initiatives aimed at enhancing infrastructure and promoting local manufacturing. Additionally, the rise in disposable incomes is contributing to a shift in consumer preferences towards modern vehicles, including SUVs and electric models.

Leading countries in this region include South Africa and the UAE, where automotive markets are expanding rapidly. The competitive landscape features both global and local players, with companies like Nissan and Toyota establishing a strong presence. The market is characterized by a mix of traditional and innovative automotive solutions, catering to diverse consumer needs and preferences.