Increased Focus on Fuel Efficiency

The Automotive Microcontrollers Market is significantly impacted by the increased focus on fuel efficiency among consumers and manufacturers alike. As fuel prices fluctuate and environmental concerns rise, there is a growing demand for vehicles that optimize fuel consumption. Microcontrollers play a pivotal role in managing engine performance, transmission systems, and hybrid technologies, thereby enhancing fuel efficiency. The market for fuel-efficient vehicles is projected to grow substantially, with estimates suggesting that by 2025, over 50% of new vehicles will incorporate advanced fuel-saving technologies. This trend not only aligns with consumer preferences but also meets regulatory requirements aimed at reducing emissions. Consequently, the Automotive Microcontrollers Market is poised for growth as manufacturers invest in microcontroller technologies that promote fuel efficiency.

Rising Demand for Connectivity Solutions

The Automotive Microcontrollers Market is witnessing a rising demand for connectivity solutions as vehicles become increasingly integrated with digital technologies. The proliferation of connected cars, which utilize microcontrollers to enable features such as vehicle-to-vehicle communication and real-time data analytics, is reshaping the automotive landscape. According to industry estimates, the connected car market is anticipated to reach USD 200 billion by 2025. This growth is driven by consumer expectations for enhanced convenience, safety, and entertainment options. Microcontrollers serve as the backbone of these connectivity solutions, facilitating seamless communication between various vehicle systems and external networks. As automakers strive to meet consumer demands, the Automotive Microcontrollers Market is likely to expand, fostering innovation in connectivity technologies.

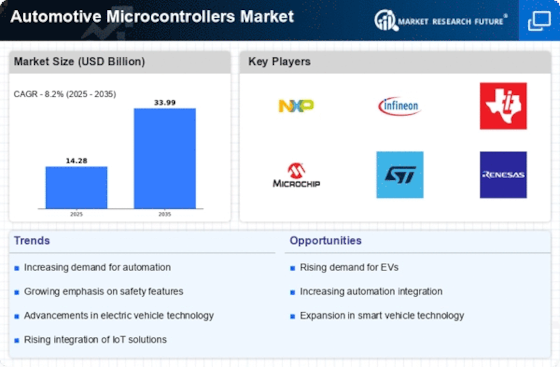

Advancements in Electric Vehicle Technology

The Automotive Microcontrollers Market is significantly influenced by advancements in electric vehicle (EV) technology. As the automotive sector shifts towards electrification, the demand for sophisticated microcontrollers that manage battery systems, power distribution, and energy efficiency is on the rise. The EV market is projected to grow at a compound annual growth rate of over 20% through 2025, necessitating the integration of advanced microcontrollers to optimize performance and reliability. These microcontrollers play a crucial role in managing the complex interactions between various vehicle systems, ensuring efficient energy usage and enhancing overall vehicle performance. Consequently, the increasing adoption of electric vehicles is expected to propel the Automotive Microcontrollers Market forward, fostering innovation and technological advancements.

Growing Demand for Enhanced Safety Features

The Automotive Microcontrollers Market is experiencing a notable surge in demand for enhanced safety features in vehicles. As consumers increasingly prioritize safety, manufacturers are integrating advanced microcontrollers to support systems such as automatic emergency braking, lane-keeping assistance, and adaptive cruise control. This trend is reflected in the projected growth of the automotive safety systems market, which is expected to reach USD 60 billion by 2025. The incorporation of microcontrollers facilitates real-time data processing and decision-making, thereby improving vehicle safety. Furthermore, regulatory bodies are imposing stricter safety standards, compelling automakers to adopt advanced microcontroller technologies. This growing emphasis on safety not only enhances consumer confidence but also drives innovation within the Automotive Microcontrollers Market.

Emergence of Autonomous Driving Technologies

The Automotive Microcontrollers Market is being transformed by the emergence of autonomous driving technologies. As automakers invest heavily in research and development to achieve higher levels of automation, the demand for advanced microcontrollers that can process vast amounts of data in real-time is increasing. These microcontrollers are essential for enabling features such as adaptive cruise control, lane departure warning, and full self-driving capabilities. The autonomous vehicle market is projected to reach USD 60 billion by 2025, indicating a robust growth trajectory. This shift towards automation not only enhances driving convenience but also raises safety standards. As a result, the Automotive Microcontrollers Market is likely to experience significant growth, driven by the need for sophisticated microcontroller solutions that support autonomous driving functionalities.