Enhanced Vehicle Safety Regulations

The automotive microcontrollers market is significantly influenced by stringent vehicle safety regulations in the US. Regulatory bodies are increasingly mandating advanced safety features in vehicles, which necessitate the incorporation of sophisticated microcontrollers. These components are essential for systems such as electronic stability control, anti-lock braking systems, and collision avoidance technologies. As of 2025, it is projected that the market for safety-related microcontrollers could grow by approximately 15% annually, driven by these regulatory requirements. The automotive microcontrollers market must adapt to these evolving standards, ensuring that manufacturers can meet compliance while enhancing vehicle safety. This regulatory landscape not only fosters innovation but also propels the demand for advanced microcontroller solutions that can integrate seamlessly with safety systems.

Rising Adoption of Electric Vehicles

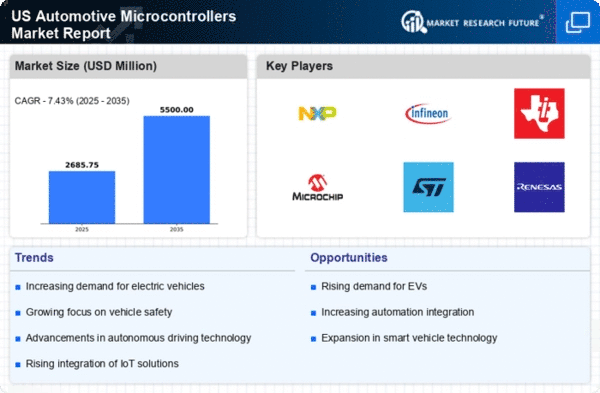

The automotive microcontrollers market experiences a notable boost due to the increasing adoption of electric vehicles (EVs) in the US. As manufacturers pivot towards sustainable mobility solutions, the demand for advanced microcontrollers that manage battery systems, power distribution, and energy efficiency rises. In 2025, it is estimated that EV sales could account for over 25% of total vehicle sales in the US, necessitating sophisticated microcontroller solutions. These microcontrollers are integral in optimizing performance and ensuring safety in EVs, thus driving growth in the automotive microcontrollers market. Furthermore, the push for zero-emission vehicles aligns with regulatory frameworks, further enhancing the market's potential. The integration of microcontrollers in EVs not only improves functionality but also supports the transition towards greener technologies.

Growth of Autonomous Driving Technologies

The automotive microcontrollers market is poised for growth as advancements in autonomous driving technologies gain traction in the US. The development of self-driving vehicles requires highly sophisticated microcontrollers capable of processing vast amounts of data from sensors and cameras in real-time. By 2025, the market for microcontrollers used in autonomous systems is expected to expand significantly, potentially reaching a valuation of $10 billion. This growth is driven by the need for reliable and efficient processing units that can support complex algorithms for navigation and decision-making. As manufacturers invest in research and development to enhance autonomous capabilities, the automotive microcontrollers market will likely see increased demand for innovative solutions that ensure safety and reliability in autonomous vehicles.

Demand for Fuel Efficiency and Emission Control

The automotive microcontrollers market is significantly driven by the growing demand for fuel efficiency and stringent emission control standards in the US. As consumers become more environmentally conscious, manufacturers are compelled to develop vehicles that meet these expectations. Microcontrollers play a crucial role in optimizing engine performance and managing emissions, thereby enhancing fuel efficiency. By 2025, it is projected that the market for microcontrollers focused on fuel efficiency could witness a growth rate of approximately 12%. This trend is further supported by government initiatives aimed at reducing carbon footprints, which necessitate the integration of advanced microcontroller technologies in vehicle design. Consequently, the automotive microcontrollers market is likely to expand as manufacturers seek innovative solutions to meet these evolving demands.

Integration of Internet of Things (IoT) in Vehicles

The automotive microcontrollers market is increasingly shaped by the integration of Internet of Things (IoT) technologies in vehicles. As vehicles become more connected, the need for microcontrollers that can handle communication protocols and data processing becomes paramount. In 2025, it is anticipated that the market for IoT-enabled microcontrollers could grow by over 20%, reflecting the rising consumer demand for connected features such as remote diagnostics, vehicle tracking, and infotainment systems. This trend indicates a shift towards smarter vehicles that enhance user experience and safety. The automotive microcontrollers market must evolve to support these IoT applications, ensuring that microcontrollers are capable of managing the complexities of connectivity while maintaining performance and security.