Focus on Safety and Comfort

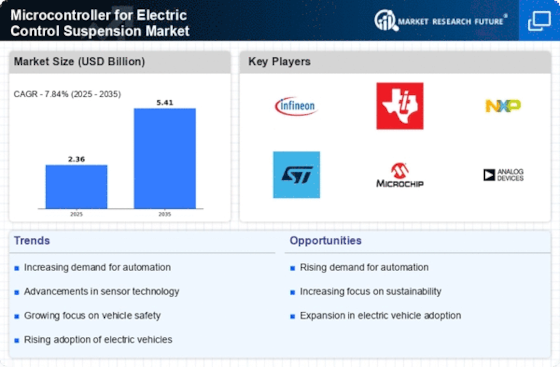

The increasing focus on safety and comfort in vehicles significantly influences the Microcontroller for Electric Control Suspension Market. Consumers are becoming more discerning, prioritizing features that enhance driving experience and safety. Microcontrollers play a crucial role in enabling adaptive suspension systems that adjust to road conditions in real-time, thereby improving vehicle stability and passenger comfort. According to recent data, the demand for vehicles equipped with advanced suspension systems is expected to grow at a CAGR of 8% over the next five years. This trend suggests that manufacturers are likely to invest more in microcontroller technology to meet consumer expectations. As safety regulations become more stringent, the integration of microcontrollers in suspension systems is anticipated to be a key factor in compliance, further driving market growth.

Rising Demand for Electric Vehicles

The rising demand for electric vehicles (EVs) is a critical driver for the Microcontroller for Electric Control Suspension Market. As consumers increasingly opt for EVs due to their environmental benefits and lower operating costs, the need for advanced suspension systems that can accommodate the unique characteristics of electric drivetrains becomes apparent. Microcontrollers are essential in managing the complexities of these systems, ensuring optimal performance and ride quality. Recent projections indicate that the EV market could reach a valuation of USD 1 trillion by 2030, which suggests a substantial opportunity for microcontroller manufacturers. This trend indicates that as the EV market expands, so too will the demand for sophisticated microcontroller solutions tailored for electric control suspension.

Integration of Advanced Technologies

The integration of advanced technologies into the Microcontroller for Electric Control Suspension Market is a pivotal driver. As automotive manufacturers increasingly adopt sophisticated systems, the demand for microcontrollers that can manage complex algorithms and real-time data processing rises. This trend is underscored by the growing emphasis on vehicle automation and connectivity. For instance, the market for electric control suspension systems is projected to reach USD 5 billion by 2026, indicating a robust growth trajectory. The ability of microcontrollers to enhance vehicle dynamics and improve ride quality is becoming essential, thereby propelling the market forward. Furthermore, advancements in sensor technology and machine learning are likely to further enhance the capabilities of these microcontrollers, making them indispensable in modern automotive applications.

Sustainability and Efficiency Initiatives

Sustainability and efficiency initiatives are increasingly shaping the Microcontroller for Electric Control Suspension Market. As environmental concerns gain prominence, automotive manufacturers are under pressure to develop more energy-efficient vehicles. Microcontrollers facilitate the implementation of electric control suspension systems that optimize energy consumption and reduce emissions. The market for electric vehicles, which often incorporate advanced suspension systems, is projected to grow significantly, with estimates suggesting a market size of USD 800 billion by 2027. This growth is likely to drive demand for microcontrollers that can enhance the efficiency of electric control suspension systems. Additionally, the push for sustainable manufacturing practices may lead to innovations in microcontroller design, further aligning with global sustainability goals.

Technological Advancements in Automotive Electronics

Technological advancements in automotive electronics are significantly impacting the Microcontroller for Electric Control Suspension Market. The rapid evolution of electronic components and systems has led to the development of more efficient and powerful microcontrollers. These advancements enable the creation of sophisticated electric control suspension systems that can adapt to various driving conditions and enhance vehicle performance. The automotive electronics market is expected to grow at a CAGR of 7% over the next five years, indicating a strong demand for innovative solutions. As manufacturers strive to differentiate their products, the integration of cutting-edge microcontroller technology in suspension systems is likely to become a competitive advantage. This trend suggests that ongoing research and development in automotive electronics will continue to drive the microcontroller market forward.