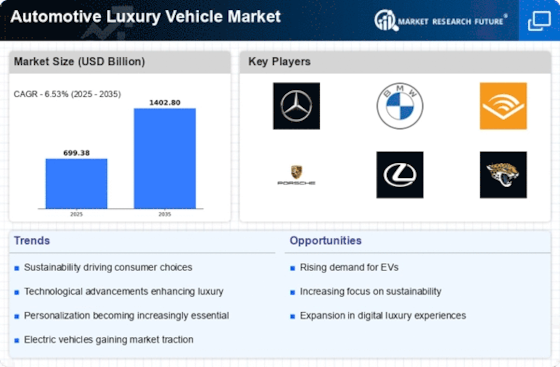

The Automotive Luxury Vehicle Market is currently characterized by intense competition and rapid innovation, driven by evolving consumer preferences and technological advancements. Key players such as Mercedes-Benz (DE), BMW (DE), and Audi (DE) are at the forefront, each adopting distinct strategies to enhance their market positioning. Mercedes-Benz (DE) emphasizes electric vehicle (EV) development, aiming to transition its lineup towards sustainability, while BMW (DE) focuses on integrating advanced digital technologies into its vehicles, enhancing user experience and connectivity. Audi (DE), on the other hand, is investing heavily in autonomous driving technologies, indicating a strategic pivot towards future mobility solutions. Collectively, these strategies not only shape their individual trajectories but also intensify the competitive landscape, pushing all players towards innovation and sustainability.

In terms of business tactics, localization of manufacturing and supply chain optimization are pivotal. The market appears moderately fragmented, with several key players exerting substantial influence. This structure allows for a diverse range of offerings, catering to various consumer segments while fostering healthy competition. The collective actions of these major companies suggest a trend towards collaboration and strategic partnerships, particularly in technology and sustainability initiatives, which may redefine market dynamics.

In August 2025, BMW (DE) announced a partnership with a leading tech firm to develop next-generation AI systems for its vehicles. This collaboration is poised to enhance the driving experience through improved safety features and personalized services, reflecting BMW's commitment to innovation. Such strategic moves not only bolster BMW's competitive edge but also signal a broader industry trend towards integrating AI into luxury vehicles, potentially reshaping consumer expectations.

In September 2025, Audi (DE) unveiled its latest electric SUV, which features cutting-edge autonomous driving capabilities. This launch underscores Audi's strategic focus on electrification and advanced technology, positioning the brand as a leader in the EV segment. The introduction of this model is likely to attract environmentally conscious consumers, further solidifying Audi's market presence in a rapidly evolving landscape.

In October 2025, Mercedes-Benz (DE) revealed its ambitious plan to achieve carbon neutrality across its production processes by 2030. This initiative not only aligns with global sustainability goals but also enhances the brand's reputation among eco-conscious consumers. The strategic importance of this move lies in its potential to differentiate Mercedes-Benz in a crowded market, as consumers increasingly prioritize sustainability in their purchasing decisions.

As of October 2025, the Automotive Luxury Vehicle Market is witnessing significant trends such as digitalization, sustainability, and AI integration. Strategic alliances are becoming increasingly vital, as companies collaborate to leverage technological advancements and enhance their offerings. Looking ahead, competitive differentiation is likely to evolve, with a pronounced shift from price-based competition to a focus on innovation, technology, and supply chain reliability. This transition may redefine consumer expectations and reshape the competitive landscape, compelling companies to continuously adapt and innovate.

Leave a Comment