Increasing Demand for Fuel Efficiency

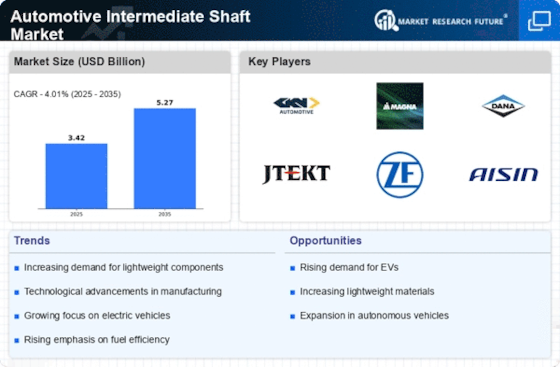

The Automotive Intermediate Shaft Market is experiencing a notable surge in demand for fuel-efficient vehicles. As consumers become more environmentally conscious, manufacturers are compelled to innovate and enhance vehicle performance. Intermediate shafts play a crucial role in optimizing power transfer and reducing energy loss, thereby contributing to overall fuel efficiency. According to recent data, vehicles equipped with advanced intermediate shafts can achieve up to 10% better fuel economy compared to traditional designs. This trend is likely to drive investments in research and development, as companies strive to meet regulatory standards and consumer expectations for lower emissions and improved mileage.

Growth of the Electric Vehicle Segment

The rise of electric vehicles (EVs) is a pivotal driver for the Automotive Intermediate Shaft Market. As the automotive landscape shifts towards electrification, the demand for components that support electric drivetrains is increasing. Intermediate shafts are essential in transmitting power from electric motors to the wheels, ensuring efficient performance. The EV market is expected to expand rapidly, with projections indicating that electric vehicles could account for a significant share of total vehicle sales by 2030. This transition necessitates the development of specialized intermediate shafts that can handle the unique requirements of electric drivetrains, thus presenting opportunities for manufacturers in the sector.

Regulatory Pressure for Emission Reductions

Regulatory frameworks aimed at reducing vehicular emissions are influencing the Automotive Intermediate Shaft Market. Governments worldwide are implementing stricter emission standards, compelling manufacturers to innovate and adopt technologies that minimize environmental impact. Intermediate shafts that enhance drivetrain efficiency can play a vital role in meeting these regulations. As a result, there is a growing emphasis on developing intermediate shafts that not only improve performance but also contribute to lower emissions. This regulatory pressure is likely to drive market growth as companies invest in cleaner technologies and seek to comply with evolving standards.

Rising Consumer Preference for Performance Vehicles

Consumer preferences are shifting towards high-performance vehicles, which is a significant driver for the Automotive Intermediate Shaft Market. Enthusiasts are increasingly seeking vehicles that offer superior handling, acceleration, and overall driving experience. Intermediate shafts are integral to achieving these performance metrics, as they facilitate efficient power transfer and enhance vehicle dynamics. The performance vehicle segment is projected to grow, with manufacturers focusing on engineering advanced intermediate shafts that can withstand higher torque and stress levels. This trend indicates a potential increase in market competition, as companies strive to deliver innovative solutions that cater to the demands of performance-oriented consumers.

Technological Advancements in Automotive Engineering

Technological advancements are significantly shaping the Automotive Intermediate Shaft Market. Innovations in materials and design methodologies are leading to the development of more robust and lightweight intermediate shafts. For instance, the introduction of composite materials has been shown to enhance durability while reducing weight, which is essential for modern vehicle performance. The market is projected to grow as manufacturers adopt these technologies to improve vehicle dynamics and safety. Furthermore, the integration of computer-aided design (CAD) and simulation tools allows for more precise engineering, which can lead to a reduction in production costs and time, thereby benefiting the overall market.