Growth of the Automotive Aftermarket

The Automotive Axle and Propeller Shaft Market is benefiting from the growth of the automotive aftermarket sector. As vehicle ownership rates rise, the demand for replacement parts and upgrades is increasing. This trend is particularly evident in regions with aging vehicle fleets, where older models require more frequent maintenance and component replacements. The aftermarket for axles and propeller shafts is expected to expand, driven by the need for enhanced performance and reliability. Additionally, the rise of e-commerce platforms is facilitating easier access to aftermarket parts, further stimulating growth in the Automotive Axle and Propeller Shaft Market. This dynamic presents opportunities for manufacturers to diversify their product offerings and cater to a broader customer base.

Increasing Demand for Electric Vehicles

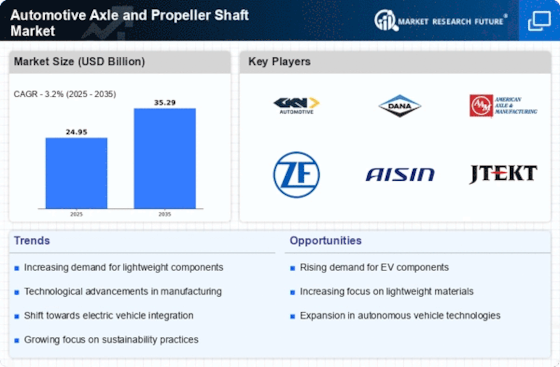

The Automotive Axle and Propeller Shaft Market is poised for growth due to the rising demand for electric vehicles (EVs). As consumers become more environmentally conscious, the shift towards EVs is accelerating, leading to a transformation in vehicle design and components. Electric vehicles often require specialized axles and propeller shafts that can accommodate different torque characteristics and weight distributions compared to traditional internal combustion engine vehicles. According to recent data, the EV market is projected to grow at a compound annual growth rate (CAGR) of over 20% in the coming years. This shift is likely to create new opportunities for manufacturers within the Automotive Axle and Propeller Shaft Market, as they adapt their products to meet the unique requirements of electric drivetrains.

Regulatory Pressure for Emission Reductions

The Automotive Axle and Propeller Shaft Market is significantly influenced by regulatory pressures aimed at reducing vehicle emissions. Governments worldwide are implementing stringent emission standards, compelling manufacturers to innovate and enhance the efficiency of their vehicles. This regulatory environment is driving the demand for lightweight and high-performance axles and propeller shafts, which contribute to overall vehicle efficiency. As a result, manufacturers are investing in research and development to create components that not only comply with regulations but also improve fuel economy. The Automotive Axle and Propeller Shaft Market is likely to see increased activity as companies strive to meet these evolving standards while maintaining competitive performance.

Technological Advancements in Automotive Axles

The Automotive Axle and Propeller Shaft Market is experiencing a surge in technological advancements, particularly in the development of advanced materials and manufacturing processes. Innovations such as computer-aided design (CAD) and finite element analysis (FEA) are enhancing the precision and efficiency of axle production. Furthermore, the integration of smart technologies, including sensors and IoT capabilities, is likely to improve performance monitoring and predictive maintenance. As a result, manufacturers are able to produce lighter, stronger, and more durable axles, which can lead to improved fuel efficiency and reduced emissions. This trend is expected to drive growth in the Automotive Axle and Propeller Shaft Market, as consumers increasingly demand vehicles that offer enhanced performance and sustainability.

Rising Consumer Preferences for Performance and Safety

The Automotive Axle and Propeller Shaft Market is also influenced by rising consumer preferences for enhanced vehicle performance and safety features. As consumers become more discerning, they are increasingly seeking vehicles that offer superior handling, stability, and safety. This trend is prompting manufacturers to invest in advanced axle designs that improve vehicle dynamics and safety performance. Innovations such as multi-link suspension systems and advanced propeller shaft designs are being developed to meet these consumer demands. The Automotive Axle and Propeller Shaft Market is likely to see a shift towards products that not only meet regulatory standards but also exceed consumer expectations for performance and safety.