Top Industry Leaders in the Automotive Foam Market

The automotive foam market, where comfort and safety intertwine in a symphony of cushioning and protection, is a bustling arena where diverse players vie for control. From established giants to nimble niche specialists, each contender employs unique strategies to navigate this dynamic landscape, shaped by evolving consumer preferences, technological advancements, and industry trends. Let's delve into the intricate layers of this market, exploring the strategies, factors influencing market share, recent developments, and the market's overall landscape.

Strategies Adopted: Shaping the Ride:

-

Diversification Titans: Industry giants like BASF, Dow, and Yanfeng Automotive Interiors invest heavily in developing diverse foam solutions, catering to a range of applications from seat cushions and headrests to sound insulation and interior panels. Think lightweight foams for enhanced fuel efficiency, fire-retardant options for safety, and bio-based alternatives for sustainability.

-

Cost-Conscious Contenders: Regional players like Tong Ren International and Shanghai Huizhou Automotive Foam focus on affordability, utilizing readily available materials and efficient production processes to cater to price-sensitive segments and emerging markets. This strategy ensures their foam solutions reach a wider audience.

-

Niche Navigators: Smaller players carve out their niches by specializing in specific applications or technologies. Some focus on high-performance foams for racing seats and sports cars, while others cater to the growing demand for innovative noise cancellation foams and environmentally friendly materials. This targeted approach allows them to excel in specialized areas.

Factors Fueling the Market Growth:

-

Electric Vehicle (EV) Surge: The burgeoning EV market, with its focus on lightweighting and interior comfort, drives demand for specialized foams that offer sound insulation, weight reduction, and enhanced passenger experience. -

Safety Regulations: Stringent safety regulations necessitate the use of fire-retardant and impact-absorbing foams in vehicle interiors, creating a significant market segment for these specific types of materials. -

Consumer Preferences: Rising consumer expectations for comfort, noise reduction, and eco-friendly materials influence the type of foams used in vehicles, pushing manufacturers to innovate and adapt. -

Technological Advancements: Developments in 3D printing, bio-based foams, and self-healing materials offer new possibilities for customization, performance, and sustainability, shaping the future of the market.

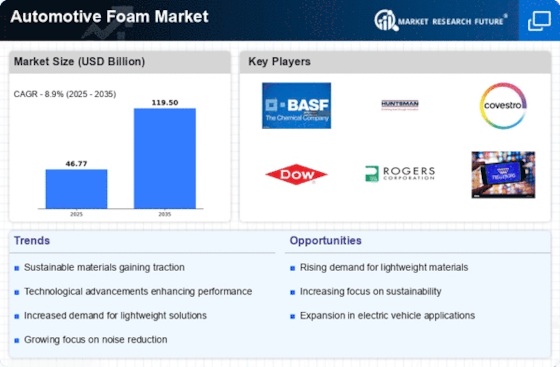

Key Players:

- Johnson Controls

- Woodbridge

- Lear Corp.

- Bridgestone Corporation

- Armacell

- Rogers Communications

- BASF SE

- Recticel

- Vitafoam Nig. PLC

- Saint-Gobain

- Stepan Company

- NGCT CleansysPvt. Ltd.

- ABRO Industries Inc.

- BG Products Inc.

- Auto Industrial Marine Chemicals Inc.

- Dun & Bradstreet Inc.

- 3M

- Radiator Specialty Company

- Cox Industries Inc.

Recent Developments:

In May 2022, "Manufacturer of the Year (above £25m)", an accolade that recognizes best practises across manufacturing organizations in North West England conferred upon The Vita Group, who have continued to stay ahead among Europe’s PU foam manufacturers according to North West Business Insider's Made in the North West awards ceremony held.

January 2022: The special meeting carried out early this year saw DuPont de Nemours approval by its shareholders on the acquisition of Rogers Corporation.

This was followed by Huntsman’s introduction during October 2021 of a new range of low-emission MDI-based foam products for automotive interior parts.

In June 2021, a mass-balance method that employs circular feedstock from waste residue in the mobility sector to create novel polyurethane solutions was unveiled by Dow. This strategy has been based on using circular feedstocks.

Momentive Performance Materials Inc. introduced its latest generation of Nix polyurethane additives in 2021 for various PU applications. The new products offer reduced emissions properties while maintaining the performance of manufacturers’ processes and final products.