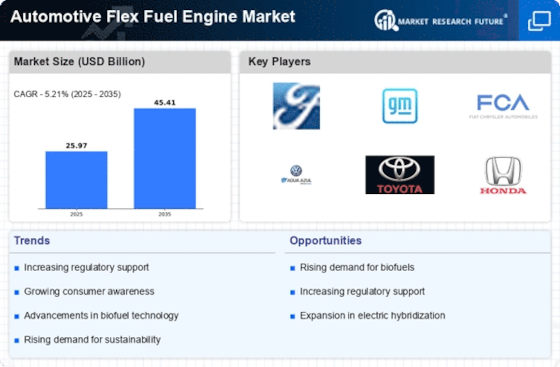

Advancements in Biofuel Technology

The Automotive Flex Fuel Engine Market is significantly influenced by advancements in biofuel technology. As research and development efforts continue to enhance the production and efficiency of biofuels, the viability of flex fuel engines is further solidified. Innovations in feedstock selection and processing techniques have led to the creation of more sustainable and cost-effective biofuels. For instance, the development of second and third-generation biofuels, derived from non-food sources, is expected to expand the market for flex fuel vehicles. By 2025, it is projected that biofuels could account for over 10% of the total fuel market, thereby providing a robust foundation for the Automotive Flex Fuel Engine Market. This trend not only supports environmental goals but also encourages manufacturers to integrate flex fuel capabilities into their vehicle offerings.

Government Incentives and Subsidies

Government incentives and subsidies play a crucial role in shaping the Automotive Flex Fuel Engine Market. Many governments are offering financial incentives to consumers who purchase flex fuel vehicles, which can significantly lower the initial cost barrier. These incentives may include tax credits, rebates, or reduced registration fees, making flex fuel vehicles more appealing to potential buyers. Additionally, manufacturers are often provided with subsidies to encourage the development and production of flex fuel engines. As of 2025, it is estimated that several countries have allocated substantial budgets to support the transition to alternative fuel vehicles, thereby enhancing the attractiveness of the Automotive Flex Fuel Engine Market. This financial support is likely to stimulate market growth and encourage wider adoption of flex fuel technology.

Increasing Environmental Regulations

The Automotive Flex Fuel Engine Market is experiencing a surge in demand due to increasing environmental regulations aimed at reducing greenhouse gas emissions. Governments worldwide are implementing stricter emissions standards, which compel manufacturers to innovate and adopt cleaner technologies. Flex fuel engines, capable of running on a blend of gasoline and biofuels, align with these regulations, offering a viable solution for compliance. As of 2025, it is estimated that over 30 countries have enacted policies promoting the use of flex fuel vehicles, thereby enhancing their market presence. This regulatory push not only encourages manufacturers to invest in flex fuel technology but also drives consumer interest in environmentally friendly vehicles, further propelling the Automotive Flex Fuel Engine Market.

Consumer Preference for Fuel Efficiency

In the Automotive Flex Fuel Engine Market, consumer preference for fuel efficiency is a pivotal driver. As fuel prices fluctuate, consumers are increasingly seeking vehicles that offer better mileage and lower operating costs. Flex fuel engines, which can utilize a variety of fuel blends, provide an attractive option for cost-conscious consumers. Recent data indicates that vehicles equipped with flex fuel technology can achieve up to 20% better fuel economy compared to traditional gasoline engines. This efficiency not only appeals to individual consumers but also to fleet operators looking to reduce fuel expenditures. Consequently, the growing emphasis on fuel efficiency is likely to bolster the Automotive Flex Fuel Engine Market, as manufacturers respond to this demand with innovative flex fuel solutions.

Rising Awareness of Renewable Energy Sources

The Automotive Flex Fuel Engine Market is benefiting from the rising awareness of renewable energy sources among consumers and policymakers alike. As the global community increasingly recognizes the importance of transitioning to renewable energy to combat climate change, flex fuel vehicles, which can utilize renewable biofuels, are gaining traction. This awareness is driving demand for vehicles that not only reduce dependency on fossil fuels but also contribute to a more sustainable future. Surveys indicate that a significant percentage of consumers are willing to pay a premium for vehicles that utilize renewable energy sources. Consequently, this growing consciousness is likely to enhance the Automotive Flex Fuel Engine Market, as manufacturers respond to consumer preferences by expanding their offerings of flex fuel vehicles.