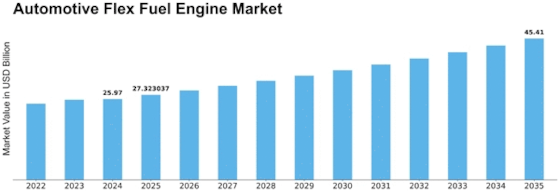

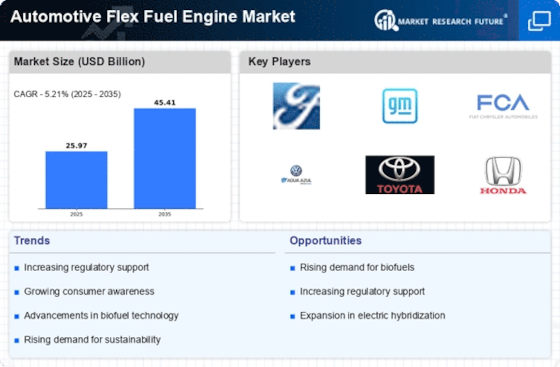

Automotive Flex Fuel Engine Size

Automotive Flex Fuel Engine Market Growth Projections and Opportunities

The market dynamics of the automotive flex-fuel engine sector are influenced by a combination of factors that reflect the evolving landscape of the automotive industry. At the heart of this market lies the global shift towards sustainable and eco-friendly transportation solutions. Flex-fuel engines, capable of running on a blend of ethanol and gasoline, have gained prominence as governments and consumers seek alternatives to traditional fossil fuels. The demand for these engines is closely tied to environmental regulations and incentives that encourage the use of biofuels, promoting a more sustainable approach to mobility.

Government policies play a pivotal role in shaping the market dynamics of automotive flex-fuel engines. Subsidies, tax incentives, and emission standards set by authorities can significantly impact the adoption of flex-fuel technology. Countries that prioritize renewable energy sources often implement policies that support the production and consumption of biofuels, thereby driving the demand for flex-fuel engines. Conversely, changes in government regulations, such as shifts in emission standards or alterations to biofuel blending requirements, can pose challenges for manufacturers operating in the flex-fuel engine market.

Consumer preferences and awareness also contribute to the market dynamics. As environmental consciousness grows, consumers are increasingly inclined towards vehicles that offer a more sustainable and eco-friendly driving experience. Flex-fuel engines provide an attractive option, allowing drivers the flexibility to choose between ethanol and gasoline based on availability and cost. The market responds to this shift in consumer behavior, with automakers focusing on the development and promotion of flex-fuel vehicles to meet the demand for more environmentally friendly transportation options.

Technological advancements are a key driver in the automotive flex-fuel engine market. Ongoing research and development efforts seek to enhance the efficiency and performance of flex-fuel engines, making them more competitive with traditional gasoline engines. Innovations in engine design, fuel injection systems, and electronic controls contribute to the overall evolution of flex-fuel technology. Manufacturers investing in research and development gain a competitive edge, as advancements in engine efficiency and compatibility with higher ethanol blends become critical factors in consumer decision-making.

The global economic landscape also influences the automotive flex-fuel engine market dynamics. Economic factors such as fuel prices and income levels impact consumer purchasing power and the overall demand for vehicles. Fluctuations in oil prices can alter the cost competitiveness of biofuels, affecting the attractiveness of flex-fuel vehicles. Additionally, economic growth and industrialization in emerging markets contribute to the expansion of the automotive sector, presenting opportunities for flex-fuel engine manufacturers to tap into new markets and demographics.

Competition within the automotive industry further shapes the market dynamics of flex-fuel engines. Key players vie for market share through strategic partnerships, mergers, and acquisitions. Collaboration with biofuel producers, infrastructure development for biofuel distribution, and brand positioning play crucial roles in gaining a competitive advantage. Pricing strategies, production efficiency, and product differentiation become essential elements for manufacturers aiming to thrive in the competitive landscape of flex-fuel engines.

Environmental considerations and sustainability objectives are becoming increasingly integral to the automotive flex-fuel engine market. With a growing emphasis on reducing carbon footprints and mitigating climate change, flex-fuel technology aligns with the global push for cleaner transportation. Manufacturers focusing on sustainability initiatives, such as the development of engines compatible with higher ethanol blends, contribute to the market's responsiveness to environmental concerns.

In summary, the automotive flex-fuel engine market dynamics are multifaceted, driven by a confluence of factors ranging from government policies and technological advancements to consumer preferences and economic conditions. As the automotive industry continues to evolve towards sustainability, flex-fuel engines play a vital role in providing a greener alternative, and market participants must navigate these dynamic forces to capitalize on emerging opportunities and address challenges in this evolving sector.

Leave a Comment