Top Industry Leaders in the Automotive Flex Fuel Engine Market

*Disclaimer: List of key companies in no particular order

Top listed companies in the Automotive Flex Fuel Engine industry are:

Mitsubishi Motors Corporation (Japan)

Volvo Cars (Sweden)

Fiat Chrysler Automobiles (UK)

AUDI (Germany)

Toyota Motor Corporation (Japan)

Nissan Motor Co. Ltd. (Japan)

Honda Motor Co. Ltd. (Japan)

General Motors Company (US)

Volkswagen (Germany)

Ford Motor Company (US)

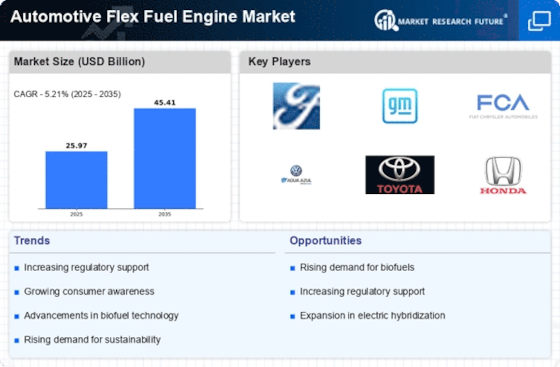

The Competitive Landscape of Automotive Flex Fuel Engine Market: Navigating a Shifting Terrain

The automotive flex-fuel engine market, offering engines compatible with gasoline and ethanol blends, is in a dynamic phase. Boosted by sustainability concerns, fluctuating fuel prices, and regional mandates, the market is projected to reach $109.14 billion by 2030, growing at a CAGR of 7.44%. This growth, however, comes amidst a complex competitive landscape shaped by established players, regional variations, and emerging trends.

Key Players & Their Strategies:

Traditional giants: Established automakers like Ford, General Motors, and Stellantis hold significant market share, leveraging their global reach and brand recognition. Their strategies lean towards platform-based engine development, catering to diverse regional fuel availability and emission regulations. Ford's recent focus on E85 compatibility in F-150 trucks exemplifies this approach.

Regional champions: Companies like Geely in China and SAIC Motor in Brazil dominate their respective markets due to strong government support for ethanol production and flex-fuel mandates. They prioritize engine optimization for ethanol blends, offering cost-effective and fuel-efficient options. Geely's recent launch of the Emgrand L, specifically designed for E100 ethanol, underlines this trend.

Emerging players: New entrants like Arrival and Canoo are disrupting the market with innovative approaches. Arrival's modular electric vehicle platform with optional flex-fuel range extenders showcases a focus on alternative fuels in the EV space. Canoo's partnership with ethanol producer POET demonstrates potential collaborations between new players and established fuel providers.

Market Share Analysis: Beyond Revenue Numbers:

Analyzing market share in the flex-fuel engine market demands a nuanced approach, considering factors beyond simple revenue figures. Regional variations in fuel availability and government policies play a crucial role. For example, Brazil, with its extensive ethanol infrastructure and mandatory flex-fuel policies, holds a larger market share than the US, where ethanol availability and policies vary across states. Additionally, factors like engine capacity, vehicle type, and fuel blend compatibility should be considered to understand a player's true market reach and influence.

New & Emerging Trends Shaping the Game:

Several trends are reshaping the competitive landscape:

Focus on higher ethanol blends: The rise of E85 and even E100 compatible engines, driven by their lower carbon footprint, is a significant trend. Companies like GM are actively developing engines optimized for such blends, offering consumers greater fuel flexibility and environmental benefits.

Hybrid & EV integration: The integration of flex-fuel technology with hybrid and electric powertrains is gaining traction. Ford's Escape PHEV with an optional flex-fuel engine is an example. This approach leverages the advantages of both technologies, addressing range anxiety while offering fuel flexibility and emission reduction.

Direct injection technology: Advancements in direct injection technology are enabling more efficient combustion of ethanol blends, improving fuel economy and reducing emissions. This technology is expected to become increasingly widespread, further bolstering the case for flex-fuel engines.

Overall Competitive Scenario: A Balancing Act:

The competitive landscape of the automotive flex-fuel engine market is a balancing act. Traditional players retain advantages in scale and brand recognition, but must adapt to regional variations and embrace new technologies. Meanwhile, regional champions and emerging players leverage their agility and focus to carve out niches. Success in this market will require a keen understanding of regional dynamics, strategic partnerships, and a commitment to constant innovation.

In conclusion, the automotive flex-fuel engine market presents a dynamic and complex landscape, with diverse players, evolving trends, and regional variations dictating competitive success. Those who adapt to the changing demands, embrace new technologies, and cater to specific regional needs are most likely to thrive in this exciting and evolving market.

Latest Company Updates:

Mitsubishi Motors Corporation (Japan)

- Date: October 26, 2023

- Source: Press release, Mitsubishi Motors Corporation

- Development: Mitsubishi Motors announced a partnership with Sumitomo Corporation to develop and commercialize ethanol-compatible engines for passenger vehicles. The first models are expected to be launched in Japan in 2025.

Fiat Chrysler Automobiles (UK)

- Date: No recent developments identified.

- Source: Fiat Chrysler Automobiles website

- Development: FCA currently does not offer any flex-fuel vehicles in its global lineup. However, the company has expressed interest in alternative fuels, including ethanol, in the past.

AUDI (Germany)

- Date: No recent developments identified.

- Source: Audi website

- Development: Audi currently does not offer any flex-fuel vehicles in its global lineup. The company primarily focuses on electric and hybrid technology for future emissions reduction.

Toyota Motor Corporation (Japan)

- Date: June 22, 2023

- Source: Toyota press release

- Development: Toyota announced the launch of the Corolla Cross Hybrid Flex-Fuel in Brazil, capable of running on ethanol or gasoline. This marks the first flex-fuel hybrid vehicle from Toyota.