Growing Complexity of Vehicle Systems

The Automotive Engineering Service Provider Market is characterized by the growing complexity of vehicle systems, which necessitates advanced engineering solutions. Modern vehicles are equipped with a multitude of interconnected systems, including infotainment, connectivity, and powertrain technologies. This complexity requires automotive manufacturers to collaborate with engineering service providers to ensure seamless integration and functionality. As vehicles become more sophisticated, the demand for specialized engineering services is expected to rise. Market analysis indicates that the automotive engineering services sector could expand significantly, driven by the need for expertise in system integration, software development, and testing. This trend underscores the vital role of engineering service providers in navigating the challenges posed by modern vehicle architectures.

Rising Focus on Research and Development

The Automotive Engineering Service Provider Market is increasingly focused on research and development (R&D) as manufacturers strive to innovate and stay competitive. The rapid pace of technological advancements in areas such as autonomous driving, connectivity, and electrification necessitates substantial investment in R&D. Automotive companies are allocating larger portions of their budgets to develop new technologies and improve existing ones. This trend is reflected in the growing number of partnerships between automotive manufacturers and engineering service providers, aimed at leveraging specialized knowledge and resources. As a result, the demand for R&D services within the automotive engineering sector is expected to rise, creating opportunities for service providers to contribute to cutting-edge developments and enhance their market positioning.

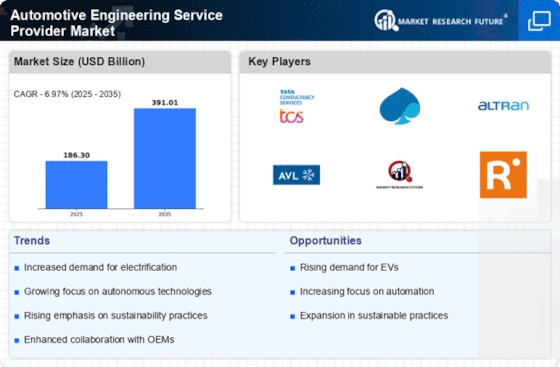

Shift Towards Electrification of Vehicles

The Automotive Engineering Service Provider Market is witnessing a significant shift towards the electrification of vehicles. This transition is largely influenced by the increasing consumer preference for electric vehicles (EVs) and the global push for sustainable transportation solutions. As governments implement stricter emissions regulations, automotive manufacturers are compelled to invest in electric powertrains and battery technologies. The electric vehicle market is anticipated to reach a valuation of several hundred billion dollars by the end of the decade. This presents a substantial opportunity for automotive engineering service providers to offer specialized services in battery design, electric motor development, and vehicle integration, thereby positioning themselves as key players in this evolving landscape.

Emphasis on Cost Efficiency and Outsourcing

The Automotive Engineering Service Provider Market is witnessing an increasing emphasis on cost efficiency and outsourcing among automotive manufacturers. In an environment characterized by intense competition and shrinking profit margins, companies are seeking ways to reduce operational costs while maintaining high-quality standards. Outsourcing engineering services allows manufacturers to leverage external expertise and resources, enabling them to focus on core competencies. Recent trends indicate that a significant percentage of automotive companies are opting to outsource various engineering functions, including design, testing, and validation. This shift presents a lucrative opportunity for automotive engineering service providers to expand their service offerings and cater to the evolving needs of manufacturers, thereby enhancing their market share.

Increasing Demand for Advanced Driver Assistance Systems

The Automotive Engineering Service Provider Market is experiencing a notable surge in demand for advanced driver assistance systems (ADAS). This trend is driven by the growing emphasis on vehicle safety and the need to comply with stringent regulatory standards. As consumers become more safety-conscious, automotive manufacturers are increasingly investing in ADAS technologies, which include features such as adaptive cruise control, lane-keeping assistance, and automatic emergency braking. According to recent data, the ADAS market is projected to grow at a compound annual growth rate of over 20% in the coming years. Consequently, automotive engineering service providers are positioned to play a crucial role in the development and integration of these sophisticated systems, thereby enhancing their market presence and driving revenue growth.