Top Industry Leaders in the Automotive Engineering Service Provider Market

*Disclaimer: List of key companies in no particular order

Top listed companies in the Automotive Engineering Service Provider industry are:

Continental AG (Germany)

AVL LIST GmbH (Germany)

Robert Bosch GmbH (Germany)

Bertrandt (Germany)

HARMAN International (USA)

EDAG Engineering GmbH (Germany)

IAV Automotive Engineering, Inc. (Germany)

Magna International Inc (Canada)

Imaginative Automotive Engineering Services (India)

Contechs (UK).

The Revving Engine of Innovation: Competitive Landscape of Automotive Engineering Service Providers

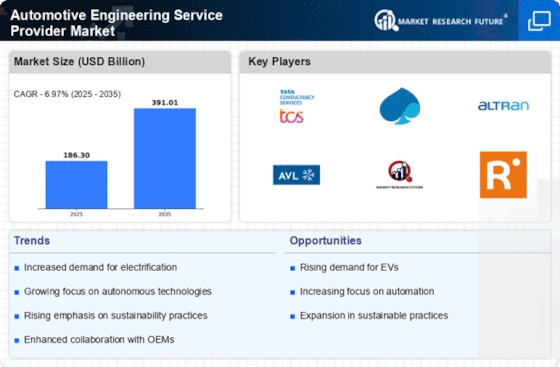

The automotive engineering service provider (ESP) market is experiencing a thrilling race towards electrification, automation, and connectivity. With a projected CAGR of 14.68% to reach USD 290.6 billion by 2027, this market is attracting leading players and hungry newcomers alike. Understanding the competitive landscape is crucial for any ESP navigating this dynamic terrain.

Key Player Strategies:

Global Giants: Tier-1 players like Bosch, Continental, and Harman leverage their existing infrastructure and deep technology expertise to provide integrated solutions across the entire vehicle lifecycle. Their focus lies on acquisitions and partnerships to expand service offerings and geographical reach.

Regional Specialists: Companies like Bertrandt (EU) and Onward Group (India) capitalize on their regional knowledge and cost-competitiveness. They cater to specific customer segments and excel in niche areas like powertrain development and lightweighting.

Emerging Challengers: Startups like Aurora and Cruise are disrupting the scene with their focus on autonomous driving technologies. They partner with established players and leverage venture capital funding to gain a foothold in the market.

Market Share Analysis:

Service Portfolio Breadth: The scope of services offered, from design and simulation to testing and validation, plays a significant role. Players with comprehensive portfolios cater to diverse customer needs, gaining an edge over specialists.

Geographical Presence: Global reach opens doors to new markets and diverse talent pools. However, regional expertise remains crucial for understanding local regulations and customer preferences.

Technological Prowess: Investment in R&D and cutting-edge technologies like AI, machine learning, and cybersecurity differentiates leading players. Continuous innovation in areas like electrification and connected car technologies is key to maintaining market share.

New and Emerging Trends:

Digital Transformation: Adoption of digital tools like cloud platforms, virtual reality, and digital twins is streamlining processes, optimizing costs, and enhancing collaboration.

Focus on Sustainability: ESPs are actively involved in developing solutions for electric vehicles, alternative fuels, and lightweight materials, aligning with the industry's shift towards decarbonization.

Talent Acquisition and Retention: Attracting and retaining skilled engineers with expertise in new technologies is crucial for success in this fast-paced market.

Overall Competitive Scenario:

The ESP market is fragmented but consolidating, with mergers and acquisitions creating larger, more competitive players. Collaboration and partnerships are also on the rise, blurring traditional lines between companies. Customer preferences are evolving, demanding flexibility, cost-effectiveness, and expertise in cutting-edge technologies. To win in this dynamic race, ESPs must continually innovate, adapt to changing trends, and deliver value-added services that address the specific needs of their customers.

Latest Company Updates:

Continental AG (Germany):

- November 2023: Announced a partnership with Qualcomm to develop advanced driver-assistance systems (ADAS) and autonomous driving solutions.

AVL LIST GmbH (Germany):

- September 2023: Collaborated with BMW on a project to develop software for highly automated driving functions. (Source: AVL website)

Bertrandt (Germany):

- October 2023: Launched a new software platform for connected car applications. (Source: Bertrandt website)