Increased Regulatory Compliance Requirements

The automotive engineering-service-provider market is significantly influenced by stringent regulatory compliance requirements. As environmental concerns escalate, regulations surrounding emissions and safety standards are becoming more rigorous. In 2025, it is estimated that compliance-related services will account for nearly 20% of the market's total revenue. Service providers must ensure that their engineering solutions meet these evolving standards, which may involve extensive testing and validation processes. This necessity for compliance not only drives demand for engineering services but also encourages innovation in sustainable practices. Consequently, the automotive engineering-service-provider market is likely to see a shift towards more eco-friendly engineering solutions.

Expansion of Electric and Hybrid Vehicle Platforms

The automotive engineering-service-provider market is being propelled by the expansion of electric and hybrid vehicle platforms. As manufacturers pivot towards electrification, there is a heightened need for specialized engineering services that support the development of these vehicles. In 2025, it is projected that electric and hybrid vehicles will constitute over 30% of new vehicle sales in the US, creating substantial opportunities for engineering service providers. This shift necessitates expertise in battery technology, electric drivetrains, and energy management systems. Consequently, the automotive engineering-service-provider market is likely to experience robust growth as it adapts to the demands of this evolving vehicle landscape.

Growing Demand for Customization and Personalization

The automotive engineering-service-provider market is witnessing a growing demand for customization and personalization in vehicle design. Consumers are increasingly seeking unique features and tailored experiences, prompting manufacturers to collaborate closely with engineering service providers. This trend is expected to contribute to a market growth rate of around 12% in the coming years. Engineering service providers are tasked with developing innovative solutions that cater to these specific consumer preferences, which may include bespoke design elements and advanced technology integrations. As a result, the automotive engineering-service-provider market is evolving to accommodate these demands, fostering a more dynamic and responsive industry.

Technological Advancements in Automotive Engineering

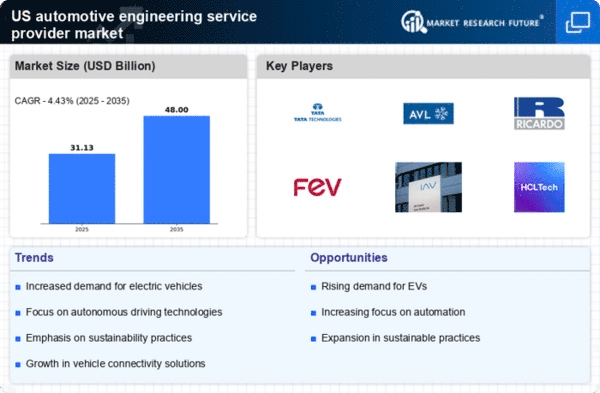

The automotive engineering-service-provider market is experiencing a surge in demand due to rapid technological advancements. Innovations in areas such as artificial intelligence, machine learning, and advanced materials are reshaping the landscape. For instance, the integration of AI in design and manufacturing processes enhances efficiency and reduces costs. In 2025, the market is projected to grow by approximately 15%, driven by these technological improvements. Service providers are increasingly required to adapt to these changes, offering specialized services that align with the latest technologies. This trend indicates a shift towards more sophisticated engineering solutions, which could potentially redefine competitive dynamics within the automotive engineering-service-provider market.

Rising Consumer Awareness and Demand for Safety Features

The automotive engineering-service-provider market is increasingly influenced by rising consumer awareness regarding safety features in vehicles. As consumers prioritize safety, manufacturers are compelled to integrate advanced safety technologies into their designs. This trend is expected to drive a market growth of approximately 10% in the next few years. Engineering service providers play a crucial role in developing and implementing these safety features, which may include advanced driver-assistance systems (ADAS) and enhanced crash safety measures. As a result, the automotive engineering-service-provider market is likely to see a significant uptick in demand for services that focus on safety innovations, reflecting the changing priorities of consumers.