Focus on Research and Development

The emphasis on research and development (R&D) within the automotive sector is a notable driver of the Automotive Engineering Services Outsourcing Market. As competition intensifies, automotive companies are increasingly investing in R&D to innovate and differentiate their products. Outsourcing engineering services allows firms to tap into specialized R&D capabilities without the burden of maintaining extensive in-house teams. This strategy not only accelerates the innovation process but also enables companies to explore new technologies and concepts more efficiently. Market trends indicate that R&D spending in the automotive sector is expected to rise, further fueling the demand for outsourced engineering services.

Rising Demand for Electric Vehicles

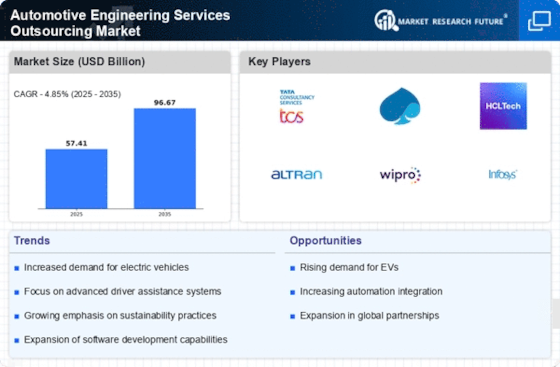

The increasing consumer preference for electric vehicles (EVs) is a pivotal driver in the Automotive Engineering Services Outsourcing Market. As manufacturers pivot towards sustainable mobility solutions, the demand for specialized engineering services to design and develop EVs has surged. Reports indicate that the EV market is projected to grow at a compound annual growth rate of over 20% in the coming years. This growth necessitates outsourcing engineering services to manage the complexities of EV technology, including battery management systems and electric drivetrains. Consequently, automotive companies are increasingly relying on external expertise to accelerate their EV development timelines and enhance product quality, thereby driving the outsourcing market.

Cost Efficiency and Resource Optimization

Cost efficiency remains a critical driver for the Automotive Engineering Services Outsourcing Market. By outsourcing engineering services, automotive companies can significantly reduce operational costs associated with hiring and training in-house engineers. This approach allows firms to allocate resources more effectively, focusing on core competencies while leveraging external expertise for specialized tasks. Market analysis suggests that companies can achieve cost savings of up to 30% by outsourcing engineering functions. This financial incentive encourages more manufacturers to consider outsourcing as a viable strategy to enhance productivity and maintain competitiveness in a rapidly evolving market.

Regulatory Compliance and Safety Standards

The stringent regulatory environment surrounding automotive safety and emissions is a significant driver in the Automotive Engineering Services Outsourcing Market. As regulations become more complex, automotive manufacturers are compelled to ensure compliance with various safety and environmental standards. Outsourcing engineering services provides access to specialized knowledge in regulatory compliance, enabling companies to navigate these challenges effectively. For example, adherence to the latest emissions standards requires advanced engineering solutions that may necessitate external expertise. This need for compliance drives demand for outsourced services, as manufacturers seek to mitigate risks associated with non-compliance and enhance their market reputation.

Technological Advancements in Automotive Engineering

The rapid evolution of technology within the automotive sector significantly influences the Automotive Engineering Services Outsourcing Market. Innovations such as artificial intelligence, machine learning, and advanced materials are reshaping vehicle design and manufacturing processes. As automotive companies strive to integrate these technologies, they often seek external engineering services to leverage specialized knowledge and capabilities. For instance, the adoption of AI in predictive maintenance and design optimization is becoming commonplace. This trend is expected to propel the outsourcing market, as firms look to enhance their competitive edge by utilizing cutting-edge technologies that may not be available in-house.