Market Trends

Key Emerging Trends in the Automotive Electric Power Steering Market

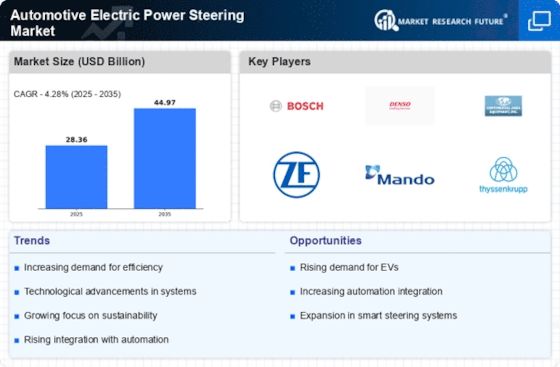

Many variables drive the vehicle electric power steering market. Customers worldwide want technically advanced cars with high-end amenities, low prices, and enhanced safety. Second, automakers want to build cleaner, greener automobiles with a lower carbon footprint which this technology may help achieve. The third reason consumers want electric power steering is to make driving more relaxing and easy. The worldwide automobile electric power steering market is expected to expand 6% from 2017 to 2023. The vehicle electric power steering (EPS) market is active and growing. To survive in this competitive environment, organizations are using market share positioning tactics.

To differentiate their EPS offers from competitors, corporations often differentiate products. This may need sophisticated qualities like accuracy, reactivity, and energy economy. Companies may get loyal customers and stand out in the market by offering unique and outstanding items.

Pricing tactics are crucial to market share positioning. Some firms lead in cost by offering high-quality EPS solutions at reduced prices. This strategy attracts price-sensitive customers and helps corporations dominate the market. Others may use premium pricing to explain their EPS systems' high quality and advanced functionality. This targets top-tier product buyers and positions organizations as industry leaders.

For Automotive EPS market share positioning, global growth is crucial. Companies explore new markets or enhance their presence in current ones to reach various consumers. Adapting items to regional demands might be vital. For instance, creating EPS systems for different road conditions, climates, and driving preferences helps firms meet distinct market expectations.

Automotive EPS market share positioning requires a customer-centric strategy. Success requires understanding and satisfying changing customer requirements. Companies that emphasize customer input, do market research, and develop their goods based on consumer preferences are more likely to create brand loyalty and market share.

Market share positioning also depends on strategic marketing and branding. A favorable brand image builds customer trust. Effective marketing initiatives that showcase EPS systems' unique features, advantages, and dependability can change customer attitudes and expand market share.

Leave a Comment