Rising Focus on Vehicle Safety Features

The electric power steering system market is positively impacted by the rising focus on vehicle safety features. As safety becomes a paramount concern for consumers and manufacturers alike, the integration of electric power steering systems plays a crucial role. These systems enhance vehicle stability and control, particularly in emergency situations. The increasing implementation of safety regulations and standards in the US automotive industry is likely to drive the adoption of electric power-steering systems. Market analysts project that the demand for safety-enhancing technologies will contribute to a steady growth trajectory for the electric power-steering-system market, with an anticipated increase in market share over the next few years.

Regulatory Support for Electric Vehicles

The electric power steering system market benefits from strong regulatory support aimed at promoting electric vehicles (EVs). Government initiatives, including tax incentives and subsidies, encourage consumers to adopt EVs, which often feature electric power steering systems. In the US, regulations mandating lower emissions and improved fuel efficiency are driving automakers to incorporate electric power-steering systems into their designs. This regulatory environment is expected to bolster market growth, as manufacturers align their products with compliance standards. The market is projected to expand as more states implement stringent emissions regulations, potentially increasing the adoption of electric power-steering systems in new vehicle models.

Growth of the Automotive Industry in the US

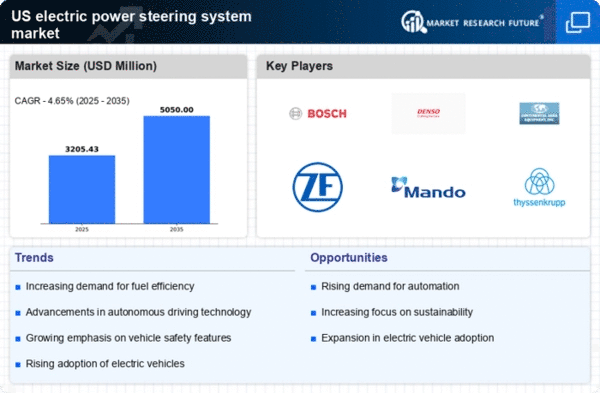

The electric power steering system market is poised for growth alongside the overall expansion of the automotive industry in the US. As vehicle production ramps up, the demand for electric power steering systems is expected to rise correspondingly. The automotive sector is projected to grow at a CAGR of approximately 4% through 2027, which bodes well for the electric power-steering-system market. This growth is driven by factors such as increasing consumer preferences for new vehicle technologies and the ongoing shift towards more efficient and environmentally friendly vehicles. Consequently, the electric power-steering-system market is likely to benefit from this upward trend in automotive production and innovation.

Technological Advancements in Steering Systems

The electric power steering system market is experiencing a surge due to rapid technological advancements. Innovations in steering technologies, such as improved sensors and control algorithms, enhance vehicle handling and safety. The integration of these technologies allows for more precise steering responses, which is crucial for modern vehicles. As manufacturers invest in research and development, the market is projected to grow significantly. For instance, the market size is expected to reach approximately $10 billion by 2026, reflecting a compound annual growth rate (CAGR) of around 7%. This growth is indicative of the increasing demand for advanced steering solutions that improve overall vehicle performance and driver experience.

Consumer Demand for Enhanced Driving Experience

The electric power steering system market is significantly influenced by consumer demand for an enhanced driving experience. Modern drivers increasingly seek vehicles that offer superior comfort, responsiveness, and safety features. Electric power steering systems provide a smoother and more controlled driving experience, which appeals to consumers. As preferences shift towards vehicles equipped with advanced steering technologies, manufacturers are compelled to innovate. Market data suggests that vehicles with electric power steering are becoming more prevalent, with estimates indicating that over 60% of new vehicles sold in the US are now equipped with this technology. This trend is likely to continue, further driving the growth of the electric power-steering-system market.