Automotive Electric Power Steering Size

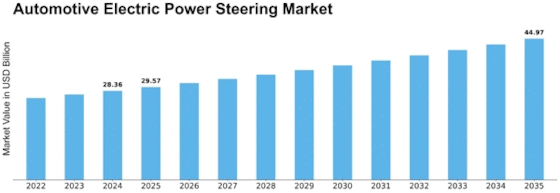

Automotive Electric Power Steering Market Growth Projections and Opportunities

The automobile industry uses motor-driven siphons to provide water-powered pressure. This siphon ran continuously, using motor power and straining the engine. Even without the steering wheel, this siphon would remain operating, reducing fuel efficiency. Electric power steering reduces fuel usage by directing the driver when the steering wheel is turned. Drag or push is still applied to the motor, but it happens only during steering development, increasing motor output.

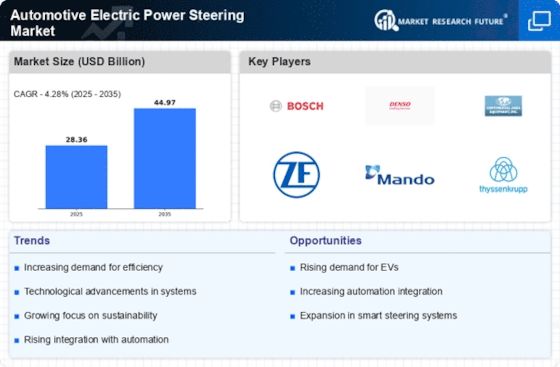

The Automotive Electric Power Steering market has changed significantly, reflecting automotive industry trends. Environmental awareness and the demand for greener technology are driving this sector. Electric Power Steering systems are more eco-friendly than pressure-driven systems. EPS market growth is driven by administrative requirements for reduced outflows and customer preferences for more efficient cars.

Globalisation and the automobile inventory network also affect the EPS market. Suppliers of EPS components and systems compete fiercely to meet the demands of global automobile manufacturers. This competitive scenario boosts development and cost-viability, driving market components. Additionally, automobile manufacturers and EPS providers have collaborated to leverage each other's innovation and market presence.

Another major factor affecting Automotive EPS is the rise of electric and independent automobiles. As the car industry moves toward charge and independence, demand for cutting-edge steering systems is rising. Electric Power Steering frameworks are crucial to the rising automotive scene since they may be combined into electric and independent vehicle stages.

Automotive EPS market components are also influenced by buyer preferences. Car purchasers increasingly value comfort, luxury, and high-end features. The smoother and more responsive driving experience of electric power steering systems matches these customer preferences. Automotive manufacturers are combining EPS to improve vehicle appeal.

Despite strong growth, Automotive EPS market elements face challenges. Cost considerations and conjecture about the outcome and implementation of cutting-edge EPS advancements are tough for smaller automobile manufacturers. Finding a balance between cost-viability and cutting-edge innovation is crucial for industry participants.

Leave a Comment