Top Industry Leaders in the Automotive Electric Power Steering Market

Traversing the Curves: Competitive Dynamics in the Automotive Electric Power Steering Market

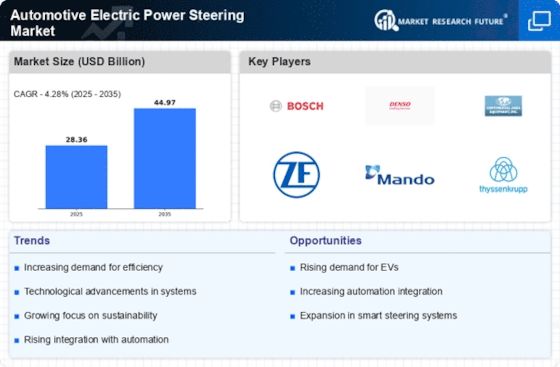

The worldwide automotive electric power steering (EPS) market is propelled by a potent blend of escalating concerns about fuel efficiency, stringent emission regulations, and the burgeoning electric vehicle (EV) sector. However, this dynamic landscape is brimming with both established behemoths and agile entrants vying for a slice of the market pie. It becomes imperative to navigate this competitive terrain by delving into their strategies, analyzing key factors, and grasping emerging trends.

Major Players:

Delphi AutomobileMitsubishi Electric CorporationHitachi Automotive Systems Ltd.TeslaShowa CorporationJTEKT CorporationNexteer AutomotiveMando CorporationRobert Bosch GmbHKSR International CompanySona Koya Steering Systems Ltd.

These companies flaunt extensive experience, robust research and development capabilities, and global supply chains, allowing them to cater to diverse original equipment manufacturers (OEMs) across various segments. Their strategies hinge on constant innovation, concentrating on the development of technologically advanced EPS systems such as dual-pinion designs, sophisticated control algorithms, and integration with driver-assistance technologies. Bosch, for example, is aggressively promoting its eSteering system, promising reduced energy consumption and enhanced precision. Meanwhile, JTEKT champions highly customizable EPS solutions tailored to specific vehicle platforms.

Rising Challengers Accelerating: While established players dominate, the market is experiencing a surge of activity from smaller yet aggressive companies. Chinese firms like HYUNDAI TRANSYS and Hanon Systems leverage cost-effective offerings to gain traction in developing economies. Startups like Mando and Magna are pushing technological boundaries with advanced software-based steering solutions and integration with autonomous driving functionalities. These emerging players adeptly adapt to rapidly changing market dynamics and forge strategic partnerships to expand their reach.

Pivotal Factors for Market Share Analysis: Deciphering the winner's circle in this competitive race demands a keen eye on key market share determinants. Vehicle type plays a pivotal role, with passenger cars currently dominating the EPS market but facing stiff competition from the burgeoning commercial vehicle segment. Regional variations are also significant, with Asia Pacific leading due to strong government support for EV adoption and a large car-buying population. Factors like fuel efficiency improvements, steering feel and responsiveness, and system cost remain major differentiators, influencing OEM and consumer preferences.

Shifting Paradigms: New and Emerging Trends: The EPS market is in a constant state of evolution, with several emerging trends reshaping the competitive landscape. The integration of EPS with advanced driver-assistance systems (ADAS) is gaining momentum, paving the way for semi-autonomous and autonomous driving technologies. The rise of electric and hybrid vehicles is driving demand for EPS systems specifically designed for these platforms, requiring expertise in motor efficiency and regenerative braking capabilities. Additionally, the focus on lightweighting and miniaturization is gaining traction, with players developing compact and energy-efficient EPS units to meet stringent fuel efficiency regulations.

The Last Stretch: Overall Competitive Landscape: The automotive EPS market is a dynamic arena where established players vie for dominance alongside agile newcomers. Understanding their strategies, key market share determinants, and emerging trends is crucial for navigating this competitive landscape. As the race towards electrification and autonomous driving intensifies, the ability to adapt to changing consumer preferences, embrace technological advancements, and forge strategic partnerships will determine who crosses the finish line first. Only by mastering these maneuvers can players thrive in this ever-evolving market and steer their way towards success.

Industry Developments and Recent Updates: Delphi Automotive (U.K):• July 2023: Delphi announced the launch of its next-generation EPS system with improved efficiency and torque density. (Source: Delphi press release)

Mando Corporation (South Korea):• October 2023: Mando unveiled its new high-precision EPS system with integrated ADAS functionalities. (Source: Mando press release)

Robert Bosch GmbH (Germany):• September 2023: Bosch received a major order from a European automaker for its latest EPS technology. (Source: Bosch press release)

KSR International Company (Canada):• June 2023: KSR launched its new compact and lightweight EPS system specifically designed for compact EVs. (Source: KSR press release)

Showa Corporation (Japan):• July 2023: Showa launched its new high-performance EPS system with faster response times and improved handling. (Source: Showa press release)