Increasing Focus on Fuel Efficiency

The Automotive Data Logger Market is also driven by an increasing focus on fuel efficiency among manufacturers and consumers alike. As fuel prices fluctuate and environmental concerns grow, there is a pressing need for vehicles that optimize fuel consumption. Data loggers provide critical insights into driving patterns, engine performance, and fuel usage, enabling manufacturers to develop more efficient vehicles. This trend is likely to gain momentum, with projections suggesting that the demand for fuel-efficient vehicles will continue to rise through 2025. Consequently, the automotive data logger market is expected to expand as manufacturers seek to enhance their offerings in response to consumer preferences for sustainability and efficiency.

Regulatory Compliance and Standards

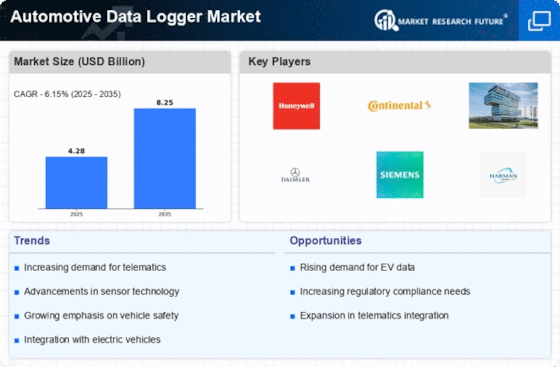

The Automotive Data Logger Market is significantly influenced by stringent regulatory compliance and standards imposed by various authorities. Governments worldwide are increasingly mandating the use of data logging systems to ensure that vehicles meet safety, emissions, and performance standards. This regulatory landscape compels manufacturers to invest in advanced data logging technologies to monitor compliance effectively. As regulations evolve, the need for accurate and reliable data logging becomes paramount. By 2025, it is anticipated that the market for automotive data loggers will grow in response to these regulatory pressures, as manufacturers strive to meet compliance requirements while enhancing vehicle performance and safety.

Rising Demand for Vehicle Safety Features

The Automotive Data Logger Market is experiencing a notable surge in demand for advanced vehicle safety features. As consumers become increasingly aware of safety standards, manufacturers are compelled to integrate sophisticated data logging systems to monitor vehicle performance and safety metrics. This trend is further supported by regulatory bodies advocating for enhanced safety protocols, which necessitate the use of data loggers to ensure compliance. In 2025, the market for automotive safety systems is projected to reach substantial figures, indicating a robust growth trajectory. Consequently, the integration of data loggers is not merely a trend but a necessity for manufacturers aiming to meet consumer expectations and regulatory requirements.

Growth of Electric and Autonomous Vehicles

The Automotive Data Logger Market is significantly influenced by the rapid growth of electric and autonomous vehicles. As these vehicles become more prevalent, the need for comprehensive data collection and analysis intensifies. Data loggers play a crucial role in monitoring battery performance, energy consumption, and vehicle dynamics, which are essential for optimizing the efficiency of electric vehicles. Furthermore, autonomous vehicles rely heavily on data logging to ensure safe operation and compliance with evolving regulations. The market for electric vehicles is anticipated to expand dramatically, with projections indicating that by 2025, electric vehicle sales could account for a substantial percentage of total vehicle sales, thereby driving the demand for automotive data loggers.

Technological Advancements in Data Logging

The Automotive Data Logger Market is propelled by continuous technological advancements in data logging solutions. Innovations such as enhanced data storage capabilities, real-time data transmission, and improved sensor accuracy are transforming the landscape of automotive data logging. These advancements enable manufacturers to gather more precise data, which is essential for performance analysis and predictive maintenance. As the automotive sector increasingly adopts connected technologies, the demand for sophisticated data loggers is expected to rise. By 2025, the market for advanced data logging technologies is projected to witness significant growth, reflecting the industry's commitment to leveraging data for improved vehicle performance and safety.