Increasing Vehicle Production

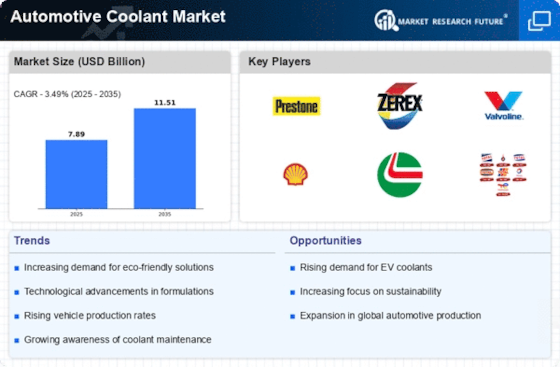

The automotive industry is witnessing a surge in vehicle production, which directly influences the Automotive Coolant Market. As manufacturers ramp up production to meet consumer demand, the need for high-quality coolants becomes paramount. In 2025, the production of passenger vehicles is projected to reach approximately 80 million units, indicating a robust growth trajectory. This increase in vehicle output necessitates a corresponding rise in coolant supply, as effective temperature regulation is critical for engine performance and longevity. Consequently, manufacturers are focusing on developing advanced coolant formulations that enhance thermal efficiency and protect engine components. The growing emphasis on vehicle performance and reliability is likely to drive the demand for automotive coolants, thereby propelling the Automotive Coolant Market forward.

Growth of Aftermarket Services

The expansion of aftermarket services is a notable driver for the Automotive Coolant Market. As vehicles age, the demand for maintenance and replacement parts, including coolants, increases. The aftermarket segment is projected to grow at a compound annual growth rate of around 5% through 2025, reflecting a rising trend in vehicle upkeep. This growth is attributed to the increasing awareness among vehicle owners regarding the importance of regular maintenance to ensure optimal performance and longevity. Consequently, automotive service providers are expanding their offerings to include a variety of coolant options, catering to diverse vehicle requirements. This trend not only boosts the sales of automotive coolants but also enhances the overall market landscape, as consumers seek reliable and effective solutions for their vehicles.

Stringent Environmental Regulations

The Automotive Coolant Market is significantly influenced by the implementation of stringent environmental regulations aimed at reducing harmful emissions. Governments across various regions are enforcing laws that mandate the use of eco-friendly coolants, which are less toxic and more sustainable. For instance, regulations concerning the use of ethylene glycol, a common coolant ingredient, have prompted manufacturers to innovate and develop alternatives that comply with environmental standards. The market for bio-based coolants is expected to expand as consumers and manufacturers alike prioritize sustainability. This shift not only aligns with regulatory requirements but also caters to the growing consumer preference for environmentally responsible products. As a result, the Automotive Coolant Market is likely to experience a transformation, with an increasing share of eco-friendly products.

Rising Popularity of Electric Vehicles

The rising popularity of electric vehicles (EVs) is emerging as a transformative factor for the Automotive Coolant Market. Although EVs operate differently than traditional internal combustion engine vehicles, they still require effective thermal management solutions. The demand for specialized coolants that can efficiently manage battery temperatures is increasing as more consumers transition to electric mobility. In 2025, it is estimated that the share of electric vehicles in the automotive market will reach approximately 20%, necessitating the development of innovative coolant solutions tailored for EV applications. This shift presents both challenges and opportunities for coolant manufacturers, as they adapt to the unique requirements of electric drivetrains. Consequently, the Automotive Coolant Market is likely to evolve, with a growing emphasis on products that cater to the needs of electric vehicles.

Technological Innovations in Coolant Formulations

Technological advancements in coolant formulations are reshaping the Automotive Coolant Market. Innovations such as the development of long-life coolants and advanced synthetic formulations are gaining traction among consumers and manufacturers. These new formulations offer enhanced thermal stability, corrosion resistance, and improved performance under extreme conditions. The market is witnessing a shift towards coolants that can withstand higher temperatures and provide better protection for engine components. As a result, manufacturers are investing in research and development to create cutting-edge products that meet the evolving needs of modern vehicles. This focus on innovation is likely to drive growth in the Automotive Coolant Market, as consumers increasingly seek high-performance solutions that align with their vehicle specifications.