Rising Vehicle Ownership

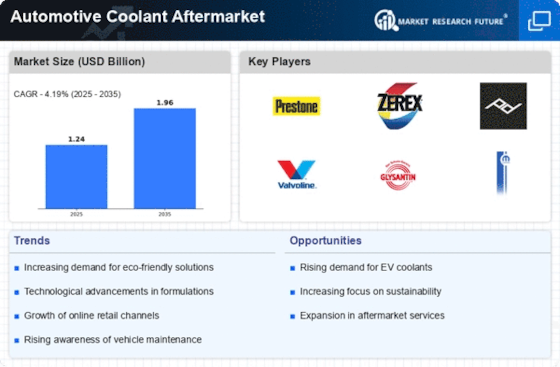

The increasing rate of vehicle ownership is a pivotal driver for the The increasing rate of vehicle ownership is a pivotal driver for the industry. Industry. As more individuals acquire vehicles, the demand for maintenance products, including coolants, escalates. In recent years, the number of registered vehicles has surged, leading to a corresponding rise in the need for automotive maintenance solutions. This trend is particularly pronounced in emerging markets, where vehicle ownership is expected to grow significantly. Consequently, the Automotive Coolant Aftermarket Industry is likely to experience heightened demand as vehicle owners seek to ensure optimal performance and longevity of their engines through regular coolant replacement and maintenance.

Growing Awareness of Vehicle Maintenance

There is a growing awareness among vehicle owners regarding the importance of regular maintenance, which serves as a significant driver for the is a significant driver for the industry. Industry. As consumers become more educated about the role of coolant in engine performance and longevity, they are more inclined to invest in quality coolant products. This trend is further supported by the proliferation of information available through digital platforms, where vehicle maintenance tips and best practices are widely shared. Consequently, the Automotive Coolant Aftermarket Industry is expected to see an uptick in demand as consumers prioritize the health of their vehicles and seek reliable coolant solutions.

Expansion of Aftermarket Distribution Channels

The expansion of aftermarket distribution channels is a crucial driver for the is a crucial driver for the industry. Industry. With the rise of e-commerce and online retail platforms, consumers now have greater access to a wide range of coolant products. This shift in purchasing behavior is reshaping the landscape of the Automotive Coolant Aftermarket Industry, as traditional brick-and-mortar stores adapt to the growing demand for online sales. Additionally, the proliferation of mobile applications and digital marketplaces facilitates easier comparison shopping, enabling consumers to make informed choices. As a result, the Automotive Coolant Aftermarket Industry is likely to benefit from increased sales and market penetration through these diverse distribution channels.

Regulatory Compliance and Environmental Standards

The is significantly influenced by regulatory compliance and environmental standards. Industry is significantly influenced by regulatory compliance and environmental standards. Governments worldwide are implementing stringent regulations regarding the use and disposal of automotive fluids, including coolants. This has led to an increased focus on eco-friendly coolant options that meet these regulations. As a result, manufacturers are compelled to innovate and produce coolants that are not only effective but also environmentally sustainable. The shift towards biodegradable and non-toxic coolants is likely to drive growth in the Automotive Coolant Aftermarket Industry, as consumers and businesses alike seek compliant and responsible products.

Technological Advancements in Coolant Formulations

Innovations in coolant formulations are transforming the Innovations in coolant formulations are transforming the industry. Industry. Manufacturers are developing advanced coolants that offer superior thermal protection, corrosion resistance, and extended service intervals. These technological advancements not only enhance engine performance but also align with the growing consumer preference for high-quality automotive products. For instance, the introduction of organic acid technology (OAT) coolants has gained traction, providing longer-lasting protection compared to traditional coolants. As consumers become more aware of the benefits of these advanced formulations, the Automotive Coolant Aftermarket Industry is poised for growth, driven by the demand for high-performance and reliable coolant solutions.