Market Share

Introduction: Navigating the Competitive Landscape of Automotive Coolants

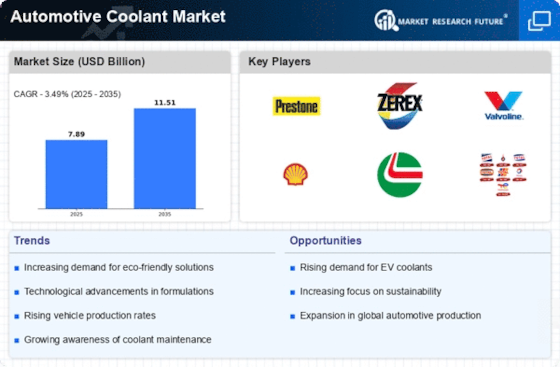

The market for automobile cooling fluids is in a state of transformation, a result of the accelerated development of technology, the tightening of regulations, and the growing demands of consumers for a higher level of performance and performance. Among the leading companies are automobile manufacturers, chemical manufacturers and new entrepreneurs. The leading companies are now relying on the latest technological advances such as Internet of Things (IoT)-based monitoring, artificial intelligence (AI)-based prediction and green formulations to compete in the market. The car makers are trying to increase the energy efficiency and reduce the emissions of their vehicles by introducing new coolant solutions, and the chemical companies are trying to meet the new standards by formulating new products. New entrants are taking advantage of the trend towards green and high-performance cooling fluids to offer consumers who are more concerned about the environment a choice. These new products and new technologies are expected to help the industry gain a competitive advantage in the long run. Especially in North America and Asia-Pacific, where the market is expected to grow rapidly, strategic deployment is required to ensure that companies maintain a competitive advantage in the automobile coolant industry by 2025.

Competitive Positioning

Full-Suite Integrators

These vendors offer a comprehensive range of automotive coolant solutions, integrating various technologies and services to meet diverse customer needs.

| Vendor | Competitive Edge | Solution Focus | Regional Focus |

|---|---|---|---|

| Exxon Mobil Corporation | Global brand with extensive distribution | Automotive lubricants and coolants | North America, Europe, Asia |

| BASF SE | Innovative chemical solutions provider | Specialty chemicals for automotive applications | Global |

| TotalEnergies | Sustainability-focused product development | Fluids and lubricants for vehicles | Europe, Africa, Asia |

| Chevron Corporation | Strong R&D capabilities | High-performance automotive fluids | North America, Asia |

| Shell Plc | Extensive product portfolio and innovation | Engine oils and coolants | Global |

Specialized Technology Vendors

These vendors focus on niche markets within the automotive coolant sector, offering specialized products that cater to specific performance requirements.

| Vendor | Competitive Edge | Solution Focus | Regional Focus |

|---|---|---|---|

| OLD WORLD INDUSTRIES | Expertise in antifreeze formulations | Automotive antifreeze and coolants | North America |

| Prestone Products Corporation | Recognized brand in coolant technology | Automotive coolant solutions | North America |

| MOTUL | High-performance synthetic products | Premium automotive lubricants and coolants | Global |

| Valvoline Inc. | Strong brand loyalty and recognition | Automotive lubricants and coolants | North America, Europe |

Infrastructure & Equipment Providers

These vendors supply the necessary infrastructure and equipment for the production and distribution of automotive coolants.

| Vendor | Competitive Edge | Solution Focus | Regional Focus |

|---|---|---|---|

| Recochem Corporation | Diverse product range and distribution | Automotive fluids and coolants | North America, Europe |

| Sinopec | Large-scale production capabilities | Petrochemical products including coolants | Asia, Middle East |

| Castrol Limited | Strong heritage in automotive lubricants | Engine oils and coolants | Global |

Emerging Players & Regional Champions

- Coolant Innovations Inc. (USA): Specializes in bio-based coolants and in environmentally friendly formulations. It recently obtained a contract with a major electric vehicle manufacturer to supply sustainable coolant solutions. It is challenging the suppliers of conventional petroleum coolants.

- THERMOGUARD SOLUTIONS: a company from Germany which offers advanced cooling systems for automobiles, recently completed a pilot project with a leading automobile manufacturer, enhancing the efficiency and performance of the cooling systems of established suppliers.

- AquaTech Coolants (India): a company specializing in the manufacture of cheap, high-performance coolants, supplying new vehicle models to local manufacturers, competing with established brands through its cost-effective solutions.

Regional Trends: In 2024, a significant change in the direction of sustainable and bio-based cooling systems, particularly in North America and Europe, is noticed. This is mainly due to increasing environmental regulations and the demand for more sustainable products from consumers. In Asia-Pacific, on the other hand, the demand for cheap cooling systems is growing, as local manufacturers try to meet the growing demand for cooling systems, focusing on cost-effectiveness and performance. Also, a trend towards specialization is noticeable, with companies focusing on advanced thermal management systems to improve the efficiency of vehicles.

Collaborations & M&A Movements

- The Prestone Products Company and BASF have entered into a joint venture to develop a new generation of coolants that will increase the efficiency of engines and reduce emissions, thereby strengthening their position in the market for green cars.

- Valvoline Inc. acquired the assets of a leading coolant manufacturer in early 2024 to expand its product portfolio and strengthen its market share in the automotive aftermarket sector.

- Shell and TotalEnergies announced a collaboration to co-develop a new line of bio-based coolants, responding to increasing regulatory pressures for sustainable automotive fluids and positioning themselves as leaders in the green technology space.

Competitive Summary Table

| Capability | Leading Players | Remarks |

|---|---|---|

| Sustainability | Prestone, Zerex | Prestone has implemented eco-friendly formulations that reduce environmental impact, while Zerex focuses on recyclable packaging and biodegradable components, showcasing their commitment to sustainability. |

| Performance Enhancement | Royal Purple, Mobil 1 | Royal Purple is a brand of engine coolant that has proven its ability to control engine temperature and improve engine performance and life. This formula is designed for use in extreme conditions, making it a good choice for high-performance vehicles. |

| Product Range Diversity | Valvoline, Peak | Valvoline provides a wide range of coolants tailored for various vehicle types, including hybrids and electric vehicles, while Peak offers specialized products for extreme climates, ensuring broad market coverage. |

| Innovation in Formulation | Aisin, Glysantin | Aisin has developed proprietary coolant technologies that enhance thermal conductivity, while Glysantin is known for its long-life formulations that reduce the need for frequent changes, demonstrating innovation in product development. |

| Consumer Education and Support | NAPA, O'Reilly Auto Parts | NAPA provides extensive consumer education through workshops and online resources about coolant maintenance, while O'Reilly Auto Parts offers personalized support and product recommendations, enhancing customer engagement. |

Conclusion: Navigating the Competitive Coolant Landscape

The future of the automobile coolant market in 2024 will be characterized by intense competition and significant fragmentation, with both established and new players competing for market share. There will be a growing emphasis on sustainable and eco-friendly formulations, which will require vendors to develop new products and solutions. Brand loyalty and a strong distribution network will remain an advantage for the established players, while the new players will focus on agility and technological innovations, especially in the areas of artificial intelligence and automation, to improve their operational efficiency. In the coming years, the market leaders will be those who will be able to leverage on sustainable initiatives, agile production, and advanced data analytics. Strategic planning and investment will be key for vendors to remain competitive in this changing landscape.

Leave a Comment