Rising Incidence of Road Accidents

The rising incidence of road accidents is a pressing concern that propels the Automotive Collision Avoidance System Market. Statistics indicate that road traffic injuries are a leading cause of death worldwide, prompting governments and organizations to prioritize safety measures. The implementation of collision avoidance systems is seen as a viable solution to mitigate these risks. As awareness of road safety increases, the demand for advanced safety technologies is expected to rise, potentially leading to a market expansion. This trend underscores the urgency for manufacturers to innovate and integrate effective collision avoidance systems into their vehicles.

Government Regulations and Incentives

Government regulations and incentives play a pivotal role in shaping the Automotive Collision Avoidance System Market. Many countries are enacting stringent safety regulations that mandate the inclusion of advanced safety features in new vehicles. These regulations not only enhance consumer safety but also encourage manufacturers to invest in innovative collision avoidance technologies. Additionally, various governments are offering incentives for consumers to purchase vehicles equipped with these systems, further driving market growth. The alignment of regulatory frameworks with technological advancements is likely to create a conducive environment for the Automotive Collision Avoidance System Market.

Integration of Artificial Intelligence

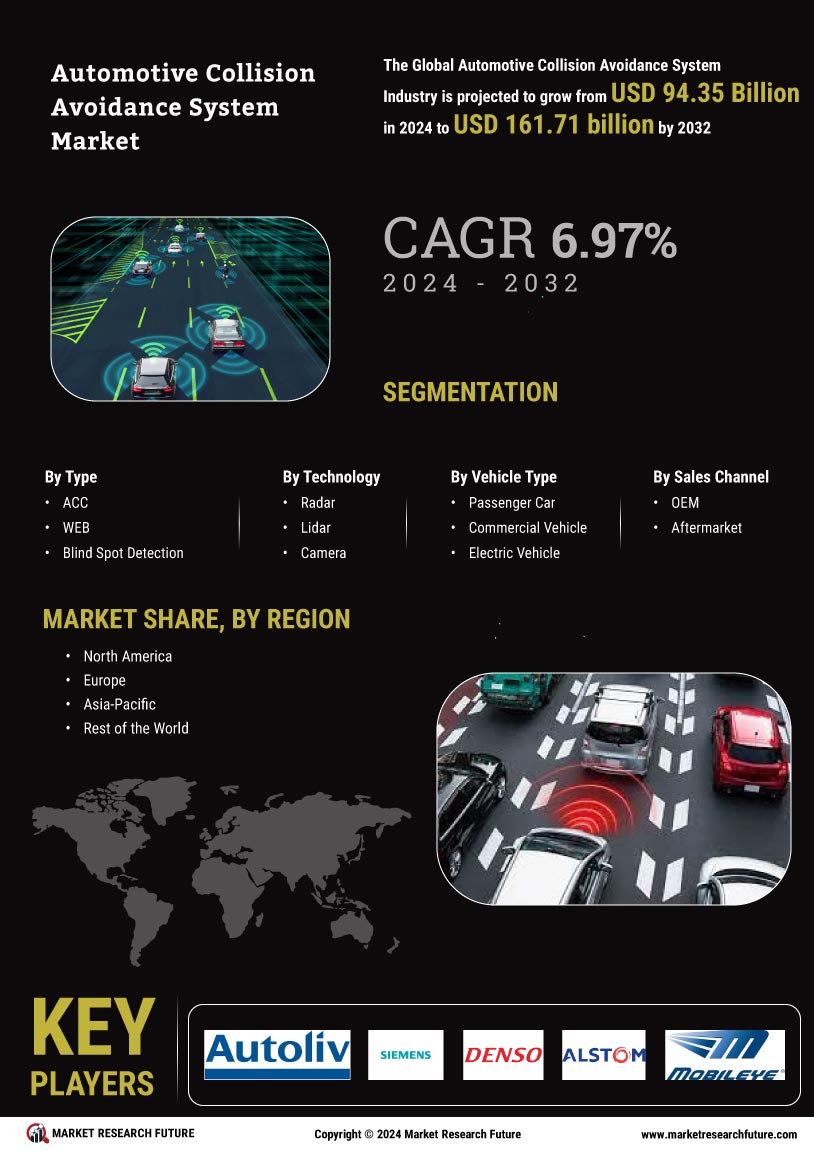

The integration of artificial intelligence (AI) into the Automotive Collision Avoidance System Market is transforming vehicle safety. AI algorithms enhance the ability of vehicles to interpret data from various sensors, allowing for real-time decision-making. This technology can predict potential collisions by analyzing driving patterns and environmental conditions. As a result, the market is projected to grow significantly, with estimates suggesting a compound annual growth rate (CAGR) of over 10% in the coming years. The increasing complexity of urban driving environments necessitates advanced AI solutions, making them a critical driver in the Automotive Collision Avoidance System Market.

Consumer Awareness and Demand for Safety

Consumer awareness regarding vehicle safety is increasingly influencing the Automotive Collision Avoidance System Market. As individuals become more informed about the benefits of collision avoidance technologies, their demand for vehicles equipped with such systems is rising. Surveys indicate that a significant percentage of consumers prioritize safety features when purchasing a vehicle, which is compelling manufacturers to enhance their offerings. This shift in consumer behavior is expected to drive market growth, as companies strive to meet the evolving expectations of safety-conscious buyers. The interplay between consumer demand and technological advancements is likely to shape the future of the Automotive Collision Avoidance System Market.

Technological Advancements in Sensor Technologies

Technological advancements in sensor technologies are a crucial driver of the Automotive Collision Avoidance System Market. The development of high-resolution cameras, radar, and lidar systems has significantly improved the accuracy and reliability of collision avoidance systems. These sensors enable vehicles to detect obstacles and assess their surroundings with remarkable precision. As sensor technology continues to evolve, the capabilities of collision avoidance systems are expected to expand, leading to enhanced safety features. The increasing integration of these advanced sensors into vehicles is likely to propel the growth of the Automotive Collision Avoidance System Market, as manufacturers seek to leverage cutting-edge technology.