Increasing Road Safety Initiatives

The automotive collision-avoidance-system market is experiencing growth due to heightened road safety initiatives across the United States. Government agencies and organizations are actively promoting safety measures to reduce traffic accidents and fatalities. In 2025, the National Highway Traffic Safety Administration (NHTSA) reported that approximately 38,000 fatalities occurred on U.S. roads, underscoring the urgent need for advanced safety technologies. As a result, Manufacturers are likely to increase investments in safety features to comply with regulations and enhance consumer trust, benefiting the automotive collision-avoidance system market. This trend suggests that the market could see a compound annual growth rate (CAGR) of around 10% over the next five years, driven by the demand for systems that prevent collisions and protect lives.

Rising Insurance Premiums and Liability Concerns

The automotive collision-avoidance-system market is also shaped by rising insurance premiums and liability concerns among vehicle owners. As insurance companies begin to factor in the safety features of vehicles when determining premiums, there is a growing incentive for consumers to invest in vehicles equipped with advanced collision-avoidance systems. In 2025, it is observed that vehicles with these systems can lead to a reduction in insurance costs by up to 15%. This financial benefit, coupled with the increasing awareness of liability issues in the event of accidents, suggests that more consumers may opt for vehicles with enhanced safety features. Consequently, the automotive collision-avoidance-system market is likely to see a surge in demand as consumers prioritize safety and cost-effectiveness.

Consumer Awareness and Education on Vehicle Safety

The automotive collision-avoidance-system market is influenced by increasing consumer awareness and education regarding vehicle safety. As more information becomes available about the benefits of collision-avoidance technologies, consumers are becoming more informed about their options when purchasing vehicles. In 2025, surveys indicate that nearly 70% of potential car buyers prioritize safety features in their decision-making process. This shift in consumer behavior suggests that manufacturers will need to focus on integrating advanced safety technologies into their offerings to meet market demand. Consequently, the automotive collision-avoidance-system market is expected to grow as consumers actively seek vehicles equipped with these life-saving technologies.

Technological Innovations in Sensor and Camera Systems

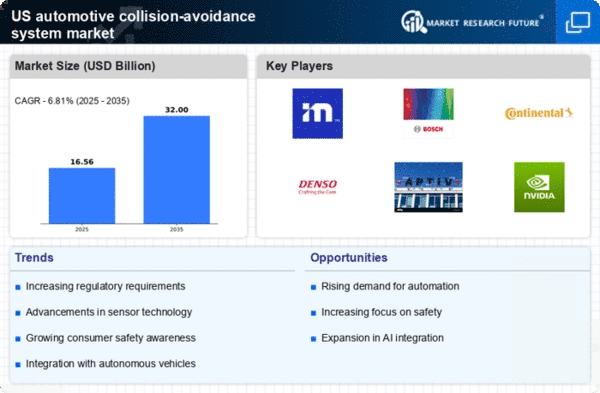

Rapid technological innovations in sensor and camera systems are propelling the automotive collision-avoidance system market. The development of high-resolution cameras, radar, and LiDAR technologies has significantly improved the accuracy and reliability of collision-avoidance systems. In 2025, advancements in these technologies are expected to enhance the performance of systems, allowing for better detection of obstacles and improved response times. This evolution in technology not only increases the effectiveness of collision-avoidance systems but also encourages manufacturers to incorporate these features into their vehicles. As a result, the automotive collision-avoidance-system market is likely to experience robust growth, with projections indicating a market size of approximately $25 billion by 2030.

Integration of Advanced Driver Assistance Systems (ADAS)

The automotive collision-avoidance-system market is significantly influenced by the integration of Advanced Driver Assistance Systems (ADAS) in vehicles. These systems, which include features such as adaptive cruise control, lane-keeping assist, and automatic emergency braking, are becoming standard in new vehicle models. As of 2025, it is estimated that over 60% of new vehicles sold in the U.S. are equipped with some form of ADAS. This widespread adoption is likely to drive the demand for collision-avoidance technologies, as consumers increasingly expect these features for enhanced safety. The automotive collision-avoidance-system market is projected to expand as manufacturers innovate and improve these systems, potentially leading to a market value exceeding $30 billion by 2030.