Automotive Collision Avoidance System Size

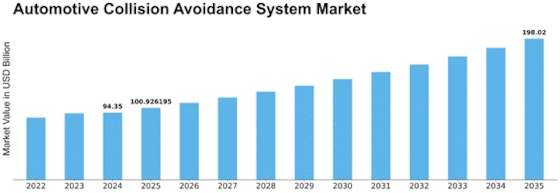

Automotive Collision Avoidance System Market Growth Projections and Opportunities

The market of Automotive Collision Avoidance System is highly affected by various factors that play a significant role in deciding the direction under which this market would grow. The first of these major motivating factors is the heightened focus on road safety. Road safety is also becoming a concern as the number of motor vehicles continues to increase on every part of earth keeping pedestrians protected. This has seen governments and regulatory bodies worldwide adopt strict safety measures, forcing manufacturers of automobiles to include sophisticated features in their vehicles. Real-time monitoring and intervention devices, such as the Automotive Collision Avoidance System have also emerged as a critical solution to these safety concerns. In addition, the growing consumer consciousness and need for ADAS drive a considerable part of market’s growth. As consumers become aware of safety features incorporated in automobiles, the crash avoidance system has grown popular for its capacity to prevent accidents or reduce their impact. Therefore, automobile manufacturers are incorporating these systems into their cars to match the consumer’s needs and have an upper hand in the market. Other important dynamics of the Automotive Collision Avoidance System market are associated with technological advancements and developments in the automobile industry. The development of modern collision avoidance systems has been made possible by the constant advancements in sensor technologies, radar systems as well as artificial intelligence. These developments improve the system’s precision, speed, and overall performance such that both manufacturers. In addition, the integrated initiatives between automotive makers and technology vendors promote market development. Partnerships and collaborations enable companies to capitalize on the strengths of one another, so their automotive knowledge couples with advanced technologies that produce effective collision avoidance systems. These types of collaborations support innovation and speed up the implementation of advanced safety technologies in automotive industry. Other economic factors that affect the Automotive Collision Avoidance System market include rising disposable incomes of consumers. With the increase in people’s income, there is a high willingness to purchase expensive vehicles with modern safety features. Furthermore, the urbanization and congestion faced by most major cities spur consumption of collision avoidance systems because they help to navigate busy streets full of speeding vehicles. However, challenges like high cost of advanced safety technologies and the complexity involved in integrating these systems into conventional vehicles inhibit market growth.

Leave a Comment