Top Industry Leaders in the Automotive Battery Management System Market

*Disclaimer: List of key companies in no particular order

Top listed global companies in the Automotive Battery Management System industry are:

Infineon Technologies AG

Texas Instrument Incorporated

Sensata Technologies

STMicroelectronics

NXP Semiconductors

Analog Devices Inc.

Renesas Electronics Corp.

Panasonic Industry Co., Ltd.

Continental AG

TDK Corporation

Marelli Holdings Co.

Johnson Matthey

Vishay Intertechnology Inc.

LEM International SA

TitanAES

Huber Automotive AG

Visteon Corporation

Mitsubishi Electric Corporation

Robert Bosch GmbH

LG Energy Solution

Bridging the Gap by Exploring the Competitive Landscape of the Automotive Battery Management System Top Players

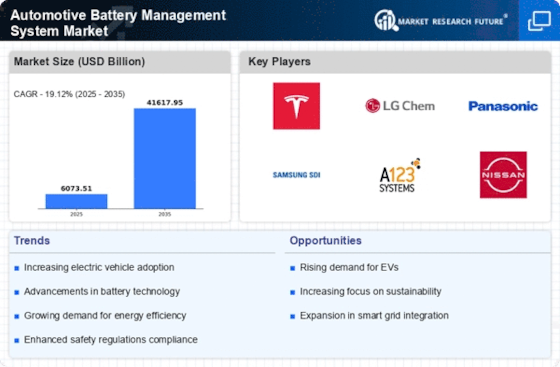

The burgeoning electric vehicle (EV) revolution is propelling the automotive Battery Management System (BMS) market into a high-stakes arena. this market is attracting established players and innovative startups alike. Understanding the competitive landscape is crucial for navigating this dynamic space.

Key Players and Strategies:

• Tier 1 Automotive Suppliers: Bosch, Continental, Denso, and LG Electronics leverage their established relationships with automakers and expertise in electrical systems to maintain a significant market share. Their strategies focus on integration with existing vehicle platforms, standardization, and offering comprehensive after-sales support.

• BMS Specialists: AAM, COSMO, and Valence Technology excel in advanced BMS technology and cater to diverse battery chemistries and vehicle types. They prioritize research and development (R&D) for features like cell balancing, thermal management, and cloud connectivity, aiming to provide differentiated solutions.

• Emerging Players: Start-ups like Echion and Octillion are disrupting the market with innovative architectures and software algorithms. They focus on modularity, scalability, and data analytics capabilities, targeting specific niches like high-performance EVs and long-distance trucks.

Market Share Analysis:

Several factors influence market share in this complex landscape:

• Technology Leadership: Companies excelling in areas like cell-to-pack communication, predictive diagnostics, and functional safety will gain prominence.

• Cost Competitiveness: Balancing advanced features with affordability is crucial, especially for mass-market EVs. Efficient manufacturing and component sourcing will be key differentiators.

• Regional Focus: Adapting to diverse regulatory frameworks and EV adoption rates across continents will be essential for global reach.

• Strategic Partnerships: Collaborations with automakers, battery manufacturers, and software providers can fast-track market penetration and technology development.

New and Emerging Trends:

The BMS market is witnessing a constant churn of innovations:

• Solid-State Batteries: As these batteries gain traction, BMS developers must adapt to their unique characteristics and operating requirements.

• AI-Powered BMS: Integration of artificial intelligence for real-time optimization, anomaly detection, and predictive maintenance is a burgeoning trend.

• Cloud-Based Solutions: Connectivity and remote monitoring platforms are gaining importance for fleet management and predictive diagnostics.

• Cybersecurity: With increased data collection and connectivity, robust cybersecurity measures are becoming a critical consideration.

Overall Competitive Scenario:

The automotive BMS market is characterized by intense competition, with established players facing challenges from nimble startups and disruptive technologies. Differentiation through unique value propositions, strategic partnerships, and continuous innovation will be crucial for success. Additionally, navigating the evolving regulatory landscape and addressing sustainability concerns will be critical for long-term market leadership.

By understanding the key players, market share dynamics, and emerging trends, stakeholders can strategize effectively and capitalize on the immense growth potential of the automotive BMS market. As the EV revolution unfolds, the race to develop the smartest, most efficient, and cost-effective BMS will shape the future of mobility.

Latest Company Updates:

Infineon Technologies AG:

• January 10, 2024: Announced the launch of its new AURIX™ safety microcontroller family for electric vehicles (EVs), which includes features for advanced battery management systems. (Source: Infineon Technologies press release)

Texas Instruments Incorporated:

• May 10, 2023: Launched new automotive battery cell and pack monitors with improved accuracy and safety features. (Source: Texas Instruments press release)

Sensata Technologies:

• May 23, 2023: Launched a new Compact Battery Management System with advanced software functions for industrial vehicles. (Source: Sensata Technologies press release)

STMicroelectronics:

• October 26, 2023: Announced the launch of its new STGWB series of gate drivers for SiC MOSFETs, which are used in battery management systems for EVs. (Source: STMicroelectronics press release)