Increasing Vehicle Safety Standards

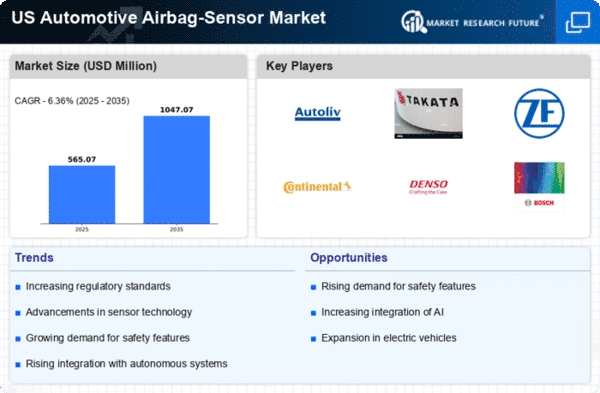

The automotive airbag-sensor market is experiencing growth due to the rising emphasis on vehicle safety standards. Regulatory bodies in the US have implemented stringent safety regulations, mandating the inclusion of advanced airbag systems in new vehicles. This has led to an increased demand for sophisticated airbag sensors that can accurately detect crash conditions and deploy airbags effectively. As of 2025, it is estimated that nearly 90% of new vehicles are equipped with multiple airbags, which necessitates the integration of reliable sensors. Consequently, manufacturers are investing in research and development to enhance sensor technology, thereby driving the automotive airbag-sensor market forward.

Growth of Electric and Autonomous Vehicles

The rise of electric and autonomous vehicles is influencing the automotive airbag-sensor market in notable ways. As these vehicles become more prevalent, the demand for advanced safety systems, including airbags, is expected to increase. Electric vehicles often feature unique design considerations that necessitate the integration of specialized airbag sensors to ensure passenger safety. Furthermore, autonomous vehicles require sophisticated sensor systems to assess crash scenarios accurately. the automotive airbag-sensor market will benefit from this trend, as manufacturers adapt their products to meet the safety requirements of next-generation vehicles.

Technological Innovations in Sensor Design

Technological innovations are playing a pivotal role in shaping the automotive airbag-sensor market. The development of advanced sensor technologies, such as MEMS (Micro-Electro-Mechanical Systems) and smart sensors, is enhancing the performance and reliability of airbag systems. These innovations allow for more precise detection of crash dynamics, leading to improved airbag deployment strategies. As of 2025, the market for MEMS-based sensors is projected to grow at a CAGR of 10%, reflecting the increasing adoption of these technologies in the automotive sector. Such advancements are likely to bolster the automotive airbag-sensor market as manufacturers strive to meet evolving consumer expectations.

Consumer Awareness and Demand for Safety Features

Consumer awareness regarding vehicle safety has significantly influenced the automotive airbag-sensor market. As more individuals prioritize safety features when purchasing vehicles, manufacturers are compelled to incorporate advanced airbag systems equipped with high-performance sensors. Surveys indicate that approximately 75% of consumers consider airbag systems a critical factor in their purchasing decisions. This growing demand for enhanced safety features is prompting automakers to collaborate with sensor manufacturers to develop innovative solutions. The automotive airbag-sensor market is thus likely to expand as consumers increasingly seek vehicles that offer superior safety technologies.

Increased Investment in Automotive Safety Technologies

Investment in automotive safety technologies is a key driver of the automotive airbag-sensor market. As automakers allocate more resources to enhance vehicle safety, the demand for advanced airbag systems and their corresponding sensors is expected to rise. In 2025, it is projected that investments in safety technologies will exceed $10 billion in the US automotive sector. This influx of capital is likely to spur innovation and development within the automotive airbag-sensor market, as companies strive to create cutting-edge solutions that comply with evolving safety standards and consumer expectations.