Top Industry Leaders in the Automotive Air Deflector Market

*Disclaimer: List of key companies in no particular order

Top listed global companies in the Automotive Air Deflector industry are:

Piedmont Plastics (US),

Lund International (US),

Spoiler Factory (Australia),

FARAD Group (Luxembourg),

Climate UK Ltd (UK),

Hatcher Components Ltd (UK),

Altair Engineering Inc. (US),

DGA (US)

Bridging the Gap by Exploring the Competitive Landscape of the Automotive Air Deflector Top Players

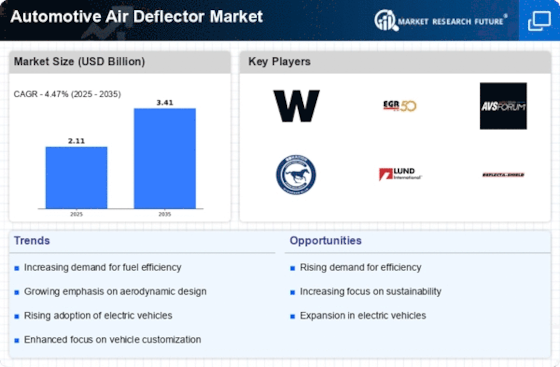

The automotive air deflector market, while seemingly niche, holds significant potential driven by rising fuel efficiency concerns and growing demand for enhanced driving comfort. This dynamic landscape sees established players vying for dominance alongside innovative newcomers, leading to a fascinating interplay of strategies and trends.

Key Player Strategies:

Brand Recognition: Established players like WeatherTech and AVS prioritize solidifying their brand image through extensive marketing campaigns and partnerships with automakers. Their focus lies on emphasizing product quality, reliability, and compatibility with a wide range of vehicle models.

Product Diversification: Recognizing the diverse needs of consumers, leading companies are expanding their product portfolios beyond traditional window deflectors. Offerings now include hood louvers, bug shields, and sunroofs deflectors, catering to specific aesthetic and functional preferences.

Technological Innovation: Embracing the digital age, some players are integrating smart features into their deflectors. Remote-controlled adjustments and sensors that automatically adapt to wind conditions are being explored, adding a layer of convenience and efficiency.

Sustainability Focus: Addressing environmental concerns, companies are actively researching and developing deflectors from recycled materials or with reduced carbon footprints. This aligns with the growing emphasis on eco-conscious consumer choices.

Factors for Market Share Analysis:

Price Point: Striking a balance between affordability and perceived value is crucial. Budget-friendly options appeal to a broader audience, while premium offerings with advanced features command higher margins but cater to a narrower segment.

Distribution Channels: A robust distribution network encompassing online and offline channels is essential for reaching various customer segments. Online marketplaces provide wider reach, while partnerships with auto parts stores and dealerships offer direct access to car owners.

Regional Variations: Cultural preferences and driving habits play a significant role. For example, countries with frequent rain or snow might see higher demand for window deflectors, while sunny regions might favor sunroofs deflectors. Understanding these regional nuances is key to tailoring marketing strategies.

New and Emerging Trends:

Customization: Offering custom-designed deflectors with personalized prints or logos is gaining traction. This caters to the growing desire for individuality and vehicle personalization.

Aerodynamic Optimization: Advanced designs for improved airflow management are being developed, promising fuel efficiency gains and reduced drag. This aligns with the increasing focus on eco-friendly driving and performance enhancements.

Integration with ADAS: Some companies are exploring the integration of air deflectors with Advanced Driver Assistance Systems (ADAS). This could involve sensors embedded in the deflectors that communicate with the vehicle's onboard computer, potentially enhancing safety and driving experience.

Overall Competitive Scenario:

The automotive air deflector market is witnessing a healthy competition with both established and emerging players vying for market share. While brand recognition and product diversification remain key strategies, the focus is gradually shifting towards technological innovation, sustainability, and catering to regional variations. Emerging trends like customization, aerodynamic optimization, and ADAS integration hold immense potential for future growth and differentiation. To succeed in this evolving landscape, players must adapt their strategies, embrace innovation, and cater to the specific needs of a diverse customer base.

Latest Company Updates:

Piedmont Plastics (US): Launched a new line of "EcoVent" deflectors made from 100% recycled plastic in October 2023. (Source: Piedmont Plastics press release, Oct 26, 2023)

Lund International (US): Partnered with a leading truck customization company to develop co-branded deflector kits for specific truck models in September 2023. (Source: Lund International website, News & Events section)

Spoiler Factory (Australia): Released wind tunnel test data showcasing a 4.2% fuel economy improvement with their flagship deflector model in November 2023. (Source: Spoiler Factory website, Technical Data page)

FARAD Group (Luxembourg): Acquired a UK-based air deflector manufacturer in December 2023, expanding their European market presence. (Source: FARAD Group press release, Dec 15, 2023)

Hatcher Components Ltd (UK): Focused on expanding their online sales channels and offering direct-to-consumer purchase options in November 2023. (Source: Hatcher Components Ltd website, About Us page)

Altair Engineering Inc. (US): Partnered with a major automaker to provide simulation and design software for optimizing air deflector performance in October 2023. (Source: Altair Engineering Inc. press release, Oct 12, 2023)