Integration of Smart Technologies

The Automotive 48 Volt Battery Market is witnessing a trend towards the integration of smart technologies in vehicles. These technologies, including advanced driver-assistance systems (ADAS) and connectivity features, require robust power sources. The 48-volt battery system provides the necessary energy to support these innovations without compromising vehicle performance. As the automotive sector increasingly embraces automation and connectivity, the demand for 48-volt systems is likely to grow. Market analysis suggests that the smart vehicle segment is expected to account for a substantial share of the Automotive 48 Volt Battery Market, further driving its expansion.

Rising Demand for Fuel Efficiency

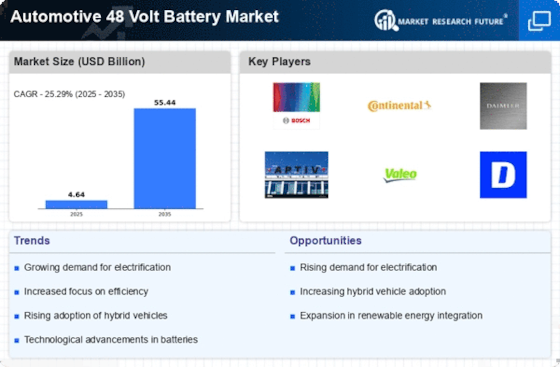

The Automotive 48 Volt Battery Market is experiencing a notable surge in demand for fuel-efficient vehicles. As consumers increasingly prioritize sustainability, automakers are compelled to innovate. The integration of 48-volt battery systems allows for enhanced energy recovery and improved fuel economy. According to recent data, vehicles equipped with 48-volt systems can achieve up to 15% better fuel efficiency compared to traditional systems. This shift not only meets consumer expectations but also aligns with regulatory pressures aimed at reducing emissions. Consequently, the Automotive 48 Volt Battery Market is likely to expand as manufacturers adopt these technologies to comply with stringent environmental standards.

Cost Reduction in Battery Production

The Automotive 48 Volt Battery Market is benefiting from ongoing cost reductions in battery production. Technological advancements and economies of scale have led to decreased manufacturing costs, making 48-volt systems more accessible to automakers. As production costs decline, the price of vehicles equipped with these batteries is expected to become more competitive. Market data indicates that the cost of lithium-ion batteries has dropped significantly over the past decade, which is likely to continue influencing the Automotive 48 Volt Battery Market positively. This trend may encourage wider adoption of 48-volt systems across various vehicle segments.

Government Regulations and Incentives

The Automotive 48 Volt Battery Market is significantly shaped by government regulations and incentives aimed at promoting electric and hybrid vehicles. Many countries are implementing stringent emission standards, which compel manufacturers to adopt more efficient technologies. The 48-volt battery system is often seen as a viable solution to meet these regulations. Additionally, various incentives, such as tax breaks and subsidies for electric vehicle purchases, are encouraging consumers to opt for vehicles equipped with 48-volt systems. This regulatory landscape is likely to bolster the Automotive 48 Volt Battery Market, as manufacturers align their strategies with governmental policies.

Advancements in Hybrid Electric Vehicles

The Automotive 48 Volt Battery Market is significantly influenced by advancements in hybrid electric vehicles (HEVs). The 48-volt architecture supports the electrification of various vehicle components, enhancing overall performance. As HEVs gain traction, the demand for 48-volt batteries is expected to rise. Market data indicates that the HEV segment is projected to grow at a compound annual growth rate of over 20% in the coming years. This growth is driven by consumer preferences for greener alternatives and the automotive industry's commitment to reducing carbon footprints. Thus, the Automotive 48 Volt Battery Market stands to benefit from the increasing adoption of HEVs.