Advancements in Robotics Technology

Robotics technology plays a pivotal role in the Automation and Control Market, with advancements leading to more sophisticated and capable systems. The integration of robotics in manufacturing processes has shown to increase production rates and enhance precision. Recent statistics indicate that the robotics segment within the automation market is expected to witness a growth rate of around 12% annually. This surge is attributed to the increasing adoption of collaborative robots, which work alongside human operators, thereby improving safety and efficiency. As industries continue to innovate, the demand for advanced robotics solutions will likely propel the Automation and Control Market forward.

Integration of Internet of Things (IoT)

The integration of Internet of Things (IoT) technologies is transforming the Automation and Control Market by enabling real-time data collection and analysis. IoT devices facilitate seamless communication between machines, leading to improved decision-making and operational efficiency. The market for IoT in automation is projected to expand at a rate of around 15% annually, as businesses recognize the value of connected systems. This integration allows for predictive maintenance, reducing downtime and operational costs. As IoT continues to evolve, its impact on the Automation and Control Market is likely to be profound, fostering innovation and efficiency.

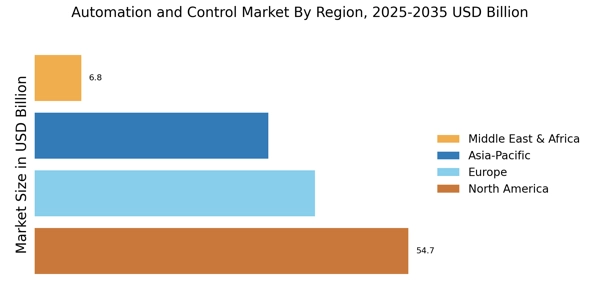

Increased Demand for Automation Solutions

The Automation and Control Market experiences heightened demand for automation solutions across various sectors. Industries such as manufacturing, logistics, and energy are increasingly adopting automation technologies to enhance operational efficiency and reduce costs. According to recent data, the automation market is projected to grow at a compound annual growth rate of approximately 9% over the next five years. This growth is driven by the need for improved productivity and the ability to respond swiftly to market changes. As companies strive to remain competitive, the integration of automation solutions becomes essential, leading to a robust expansion of the Automation and Control Market.

Regulatory Compliance and Safety Standards

The Automation and Control Market is significantly influenced by the need for regulatory compliance and adherence to safety standards. As industries face stringent regulations regarding operational safety and environmental impact, the adoption of automation technologies becomes a strategic necessity. Companies are increasingly investing in automated systems that not only enhance productivity but also ensure compliance with safety regulations. Data suggests that the market for safety automation solutions is expected to grow by approximately 8% in the coming years. This trend indicates that organizations are prioritizing safety and compliance, thereby driving growth within the Automation and Control Market.

Focus on Energy Efficiency and Sustainability

The Automation and Control Market is increasingly focusing on energy efficiency and sustainability as organizations seek to reduce their carbon footprint. Automation technologies are being leveraged to optimize energy consumption in various processes, leading to significant cost savings and environmental benefits. Recent studies indicate that energy-efficient automation solutions can reduce energy usage by up to 30%. This emphasis on sustainability is not only a response to regulatory pressures but also a strategic move to enhance brand reputation. As companies prioritize sustainable practices, the demand for energy-efficient automation solutions is expected to drive growth in the Automation and Control Market.