Rising Demand for Biopharmaceuticals

The increasing demand for biopharmaceuticals is a primary driver of the Automated Cell Culture Equipment Market. As the healthcare sector continues to evolve, the need for advanced therapies, including monoclonal antibodies and cell-based therapies, has surged. This trend is supported by data indicating that the biopharmaceutical market is projected to reach approximately USD 500 billion by 2025. Consequently, the Automated Cell Culture Equipment Market is experiencing heightened demand as these technologies are essential for the production and development of biopharmaceuticals. The efficiency and scalability offered by automated systems are likely to enhance productivity, thereby meeting the growing needs of the biopharmaceutical sector.

Technological Innovations in Automation

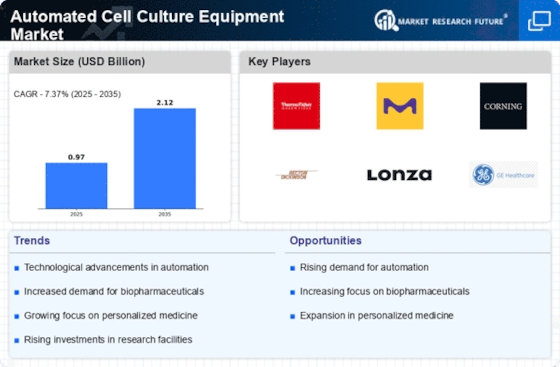

Technological innovations in automation are reshaping the landscape of the Automated Cell Culture Equipment Market. Advancements in robotics, artificial intelligence, and machine learning are enhancing the capabilities of automated systems, making them more efficient and user-friendly. For instance, the integration of AI in cell culture processes allows for real-time monitoring and optimization, which can lead to improved outcomes. The market for automated cell culture equipment is projected to grow at a compound annual growth rate (CAGR) of around 10% through 2025, driven by these technological advancements. As laboratories increasingly adopt these innovations, the Automated Cell Culture Equipment Market is poised for substantial growth.

Increased Focus on Research and Development

The emphasis on research and development (R&D) in the life sciences sector significantly propels the Automated Cell Culture Equipment Market. With a growing number of research institutions and pharmaceutical companies investing in R&D, the demand for sophisticated cell culture technologies is on the rise. Reports suggest that R&D spending in the life sciences is expected to exceed USD 200 billion by 2025. This investment is likely to drive the adoption of automated cell culture systems, which facilitate high-throughput screening and reproducibility in experiments. As researchers seek to accelerate their findings, the Automated Cell Culture Equipment Market stands to benefit from this trend.

Growing Adoption of 3D Cell Culture Techniques

The growing adoption of 3D cell culture techniques is a notable driver of the Automated Cell Culture Equipment Market. Unlike traditional 2D cultures, 3D cell cultures provide a more accurate representation of in vivo environments, leading to better predictive models for drug testing and disease research. This shift towards 3D methodologies is supported by a market analysis indicating that the 3D cell culture market is expected to reach USD 2 billion by 2025. As researchers and pharmaceutical companies recognize the advantages of 3D cultures, the demand for automated systems that can support these techniques is likely to increase, thereby benefiting the Automated Cell Culture Equipment Market.

Regulatory Support for Advanced Cell Culture Technologies

Regulatory support for advanced cell culture technologies is increasingly influencing the Automated Cell Culture Equipment Market. Regulatory bodies are recognizing the importance of innovative cell culture methods in drug development and safety testing. This support is evident in the establishment of guidelines that encourage the use of automated systems to enhance reproducibility and reduce variability in experiments. As regulatory frameworks evolve to accommodate these advancements, the market for automated cell culture equipment is expected to expand. The alignment of regulatory policies with technological progress may foster greater adoption of automated solutions, thereby driving growth in the Automated Cell Culture Equipment Market.