Rising Demand for Drug Discovery

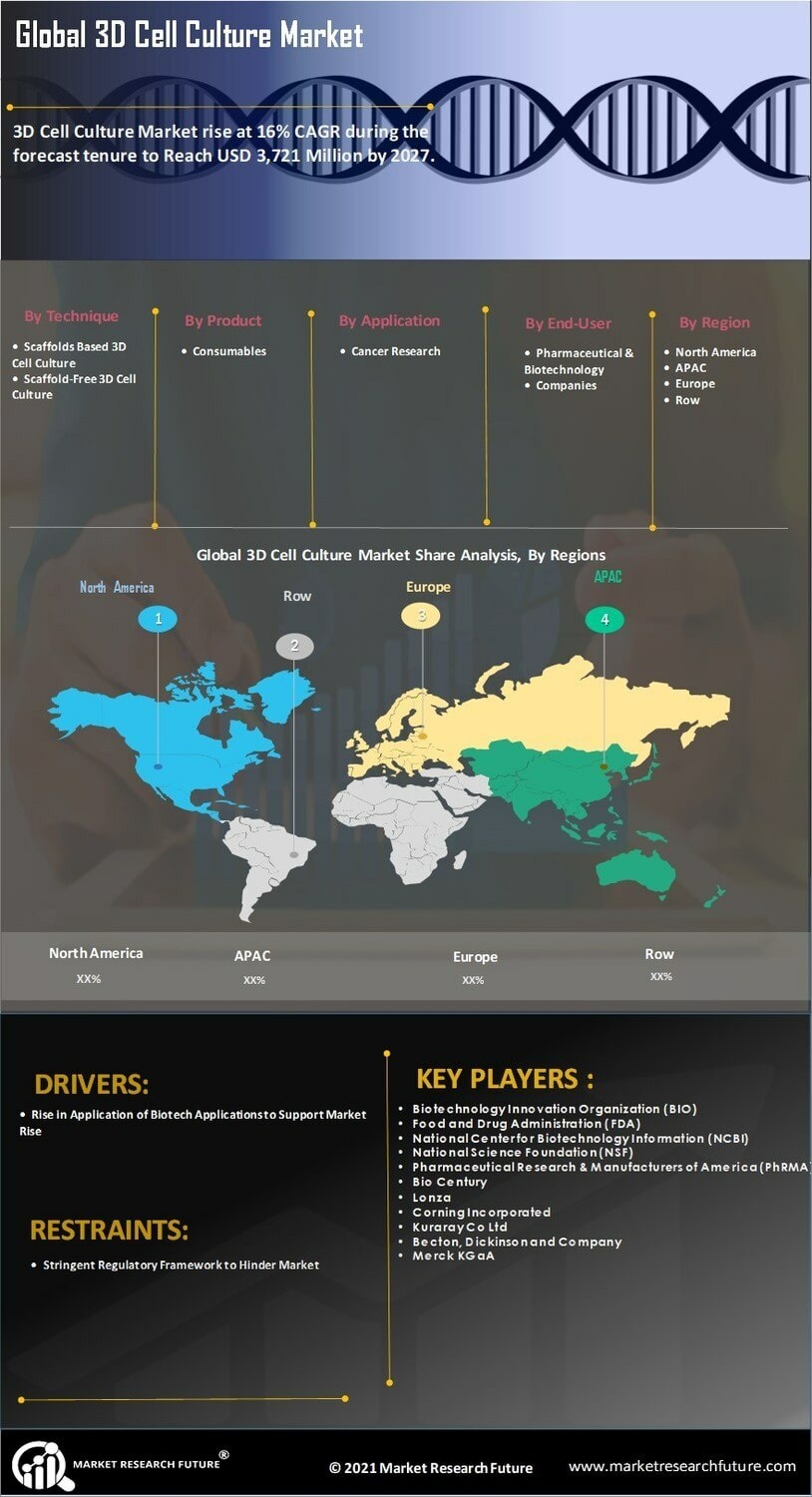

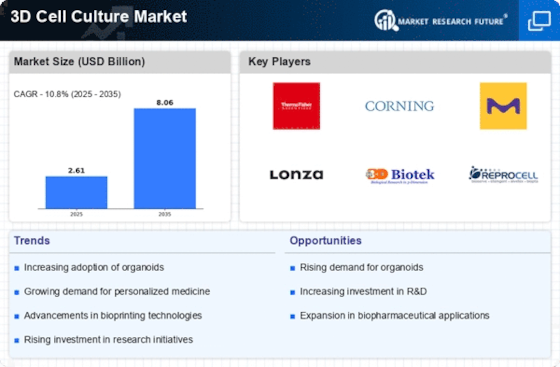

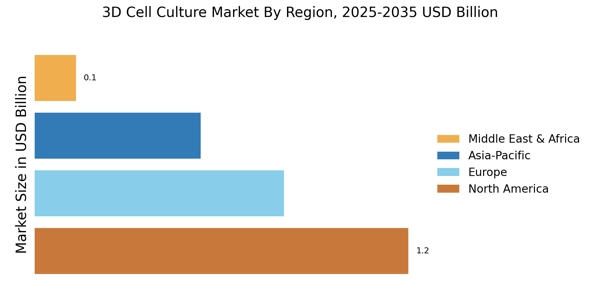

The 3D Cell Culture Market is experiencing a notable increase in demand for drug discovery applications. This trend is largely driven by the need for more predictive models that can better mimic human physiology compared to traditional 2D cultures. As pharmaceutical companies seek to enhance the efficiency of their drug development processes, the adoption of 3D cell culture technologies is becoming more prevalent. Reports indicate that the market for drug discovery using 3D cell cultures is projected to grow significantly, with estimates suggesting a compound annual growth rate (CAGR) of over 15% in the coming years. This growth is indicative of the industry's shift towards more innovative and effective methodologies in drug testing and development.

Advancements in Tissue Engineering

The 3D Cell Culture Market is witnessing substantial advancements in tissue engineering, which is reshaping the landscape of regenerative medicine. Innovations in biomaterials and scaffold design are enabling the creation of more complex tissue structures that closely resemble native tissues. This evolution is crucial for applications in transplantation and disease modeling. The market for tissue engineering is expected to expand, with projections indicating a potential growth rate of around 20% annually. Such advancements not only enhance the capabilities of 3D cell cultures but also open new avenues for research and therapeutic applications, thereby driving the overall market forward.

Emergence of Personalized Medicine

The 3D Cell Culture Market is significantly impacted by the emergence of personalized medicine, which emphasizes tailored treatment approaches based on individual patient profiles. 3D cell cultures offer the potential to create patient-specific models that can predict responses to therapies more accurately than traditional methods. This capability is particularly valuable in oncology, where understanding tumor behavior is critical for effective treatment planning. The market for personalized medicine is projected to grow substantially, with estimates suggesting a CAGR of over 10% in the next few years. This trend underscores the importance of 3D cell cultures in advancing personalized therapeutic strategies.

Growing Awareness of Ethical Considerations

The 3D Cell Culture Market is increasingly influenced by growing awareness of ethical considerations surrounding animal testing. As regulatory bodies and consumers advocate for more humane research practices, the demand for alternative methods, such as 3D cell cultures, is rising. This shift is prompting researchers to adopt 3D models that not only reduce reliance on animal testing but also provide more relevant biological insights. The market is likely to see a surge in adoption rates as institutions and companies align their practices with ethical standards. This trend not only supports the market's growth but also enhances its reputation within the scientific community.

Increased Investment in Research and Development

The 3D Cell Culture Market is benefiting from increased investment in research and development across various sectors, including biotechnology and pharmaceuticals. This influx of funding is facilitating the exploration of novel applications for 3D cell cultures, such as cancer research and toxicology studies. As organizations recognize the limitations of traditional cell culture methods, they are allocating more resources towards developing advanced 3D models. Data suggests that R&D spending in this area could reach billions of dollars, reflecting a strong commitment to innovation. This trend is likely to propel the market further, as new discoveries and technologies emerge.