Market Share

Aseptic Automatic Filling Machine Market Share Analysis

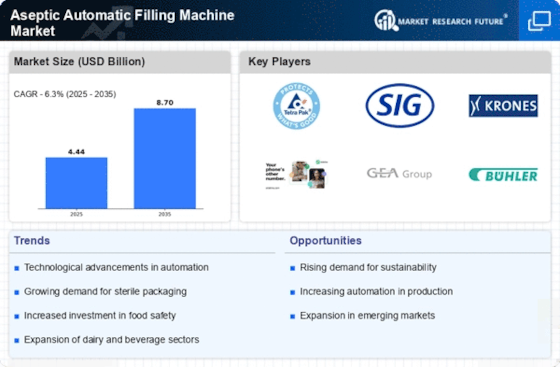

Market share positioning systems are crucial to companies' success and growth in the Aseptic Automatic Filling Machine Market. Aseptic automatic filling machines are essential in food and drink, pharmaceuticals, and beauty care industries to maintain fluid sterility. Market players use several important systems to obtain an edge.

Companies create cutting-edge aseptic automatic filling machine features and mechanics. This increases machine efficiency and quality and attracts creative clients. Companies can stand out and gain market share by offering fast filling, high-level aseptic handling, and simple interfaces.

Market actors use valuing methods to position market shares. Some companies take an expense initiative by selling their machines cheaply to attract cost-conscious customers. Others emphasize premium pricing, calling their products top-notch and mechanically unmatched. The choice between these methods depends on factors such production costs, brand image, and aseptic filling machine value.

industry share in the aseptic automatic filling machine industry depends on key companies and coordinated efforts. Companies often partner with suppliers, merchants, and other industry participants to expand their reach and market share. Sharing expertise, technology, and resources can help companies improve product offerings and customer service.

Topographical development is another important market strategy. Aseptic automatic filling machines become more popular worldwide, companies look for strengths in critical locations. This includes establishing up distribution networks, local assembly offices, and customizing products for different markets. Companies can attract new customers and increase market share by decisively expanding their topographical impression.

Aseptic filling machine market share depends on compelling marketing and marking methods. Client loyalty and trust come from serious picture strengths. Companies market their aseptic filling machines' reliability, efficiency, and creativity. Focusing on customer training and after-sales support can also boost an organization's reputation, making it a client favorite.

To compete in the aseptic automatic filling machine business, constant innovation is needed. To anticipate client wants and stay ahead of mechanical trends, companies invest in innovation. Better-than-ever aseptic filling equipment help companies attract and retain customers. Additionally, advancement allows companies to easily adapt to changing industry standards.

Delivering high-quality products and excellent customer service builds customer relationships. Companies that focus on customer loyalty, address issues quickly, and offer tailored solutions are likely to gain market share and customer loyalty.

Leave a Comment