Market Trends

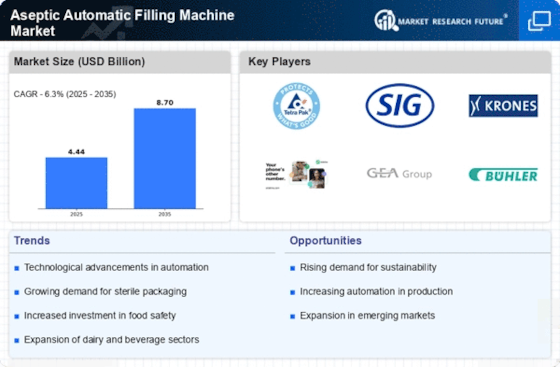

Key Emerging Trends in the Aseptic Automatic Filling Machine Market

Aseptic Automatic Filling Machine market trends are driven by technical advances and customer preferences. Aseptic bundling is becoming more popular in food, pharmaceuticals, and medical care. Aseptic filling machines are crucial to maintaining product sterility, extending usage, and ensuring consumable safety.

Assembly processes are increasingly mechanized, and the Aseptic Automatic Filling Machine market is no exception. The need for increased proficiency, higher production limitations, and less human interaction to reduce defilement drives mechanization. Automatic aseptic filling machines speed up production and save long-term costs.

Aseptic filling machines are also following the eco-friendly trend of supporting bundling configurations. Manufacturers are reducing the environmental impact of packaging materials and cycles. Aseptic packaging, which eliminates additives and refrigeration, meets the global maintainability plan. This trend is driving Aseptic Automatic Filling Machine market innovations that improve asset utilization and reduce waste.

Aseptic Automatic Filling Machine demand is driven by the food and drink industry's growing demand for safe and convenient packing. Buyers are increasingly seeking products with extended usability without compromising quality, taste, or health. Aseptic filling machines allow manufacturers to meet these objectives by preserving product freshness and eliminating synthetic additives.

Due to the importance of sterility in drug production, the Aseptic Automatic Filling Machine market is booming in pharmacy and medical services. As the pharma industry grows, cutting-edge filling methods that ensure product security and compliance become essential. Aseptic filling machines with cutting-edge technology are essential for drug companies meeting the highest standards.

Due to rapid industrialization and population growth, Asia-Pacific is becoming a major Aseptic Automatic Filling Machine market. Aseptic filling systems are in demand due to the local pharmaceuticals industry and increased use of packaged food and drinks. Market players are focusing on this area, offering innovative and practical automatic filling devices to meet the needs of thriving markets.

Leave a Comment