Top Industry Leaders in the ASEAN energy transition market

*Disclaimer: List of key companies in no particular order

Top listed global companies in the ASEAN energy transition industry are:

Exelon Corporation

Duke Energy Corporation

Pacific Gas and Electric Company

Southern Company

American Electric Power

Edison International

Repsol

Brookfield Renewable Partners

Ørsted A/S

NextEra Energy, Inc

Bridging the Gap by Exploring Top Leaders Competitive Landscape of the ASEAN energy transition Market

The ASEAN energy transition market is witnessing a dynamic shift, driven by ambitious climate goals, surging energy demand, and evolving technological advancements. This has ignited fierce competition among a diverse group of players, each vying for a foothold in this rapidly expanding landscape.

Key Player Strategies:

- Traditional Energy Giants: Incumbent oil and gas majors like Shell, ExxonMobil, and TotalEnergies are adopting a multi-pronged approach. They are investing in renewable energy projects, acquiring cleantech startups, and developing carbon capture and storage (CCS) technologies to maintain their market relevance.

- Renewable Energy Developers: Companies like Ørsted, ENGIE, and AC Energy are aggressively expanding their renewable energy portfolios across the region, focusing on solar, wind, and hydropower projects. They are leveraging their expertise and economies of scale to gain market share.

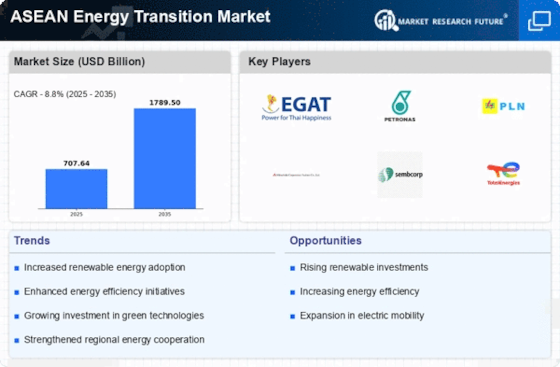

- Regional Utilities: Local players like PLN (Indonesia), PETRONAS (Malaysia), and Electricity Generating Public Company Limited (EGAT) in Thailand are investing in grid modernization and smart grid technologies to integrate renewable energy into their existing infrastructure. They are also exploring opportunities in distributed generation and microgrids.

- Tech Giants: Companies like Google and Microsoft are entering the fray through cloud-based energy management solutions, data analytics platforms, and blockchain-powered energy trading systems. They aim to capitalize on the growing demand for digitalization in the energy sector.

- Startups and SMEs: A vibrant ecosystem of innovative startups and SMEs is emerging, focusing on niche areas like energy storage, electric vehicle charging infrastructure, and green hydrogen production. These agile players are disrupting the market with their innovative solutions and cost-effectiveness.

Factors for Market Share Analysis:

- Policy and Regulatory Environment: Government policies and regulations play a crucial role in shaping the competitive landscape. Countries with attractive feed-in tariffs, tax breaks, and streamlined permitting processes will attract more investments and drive market share gains for certain players.

- Technology and Innovation: Companies with access to cutting-edge technologies and the ability to innovate will be better positioned to capture market share. This includes advancements in renewable energy generation, energy storage, and smart grid technologies.

- Project Financing and Risk Mitigation: Access to capital and the ability to mitigate risks associated with renewable energy projects will be key differentiators. Companies with strong financial backing and expertise in risk management will have an edge.

- Local Partnerships and Community Engagement: Building strong partnerships with local communities and businesses will be crucial for successful project development and long-term market share growth.

New and Emerging Trends:

- The Rise of Green Hydrogen: Hydrogen is gaining traction as a clean fuel source, with several pilot projects underway in the region. Companies involved in hydrogen production, storage, and transportation are expected to witness significant growth in the coming years.

- The Decentralization of Power: The traditional centralized power generation model is being challenged by the rise of distributed generation and microgrids. This trend presents opportunities for players offering solar rooftop solutions, energy storage systems, and microgrid management technologies.

- The Integration of Digital Technologies: Digitalization is transforming the energy sector, with companies leveraging AI, IoT, and blockchain to optimize grid operations, enhance energy efficiency, and enable peer-to-peer energy trading.

Overall Competitive Scenario:

The ASEAN energy transition market is characterized by intense competition, with a diverse range of players vying for market share. Success will depend on a combination of factors, including strong policy support, cutting-edge technology, access to finance, local partnerships, and the ability to adapt to emerging trends. While traditional energy giants have the advantage of established infrastructure and financial resources, renewable energy developers, tech giants, and innovative startups are well-positioned to disrupt the market with their agility and focus on clean energy solutions. The race for market leadership is on, and the next few years will be crucial in determining the winners and losers in this dynamic and transformative market.

Latest Company Updates:

Exelon Corporation:

- Jan 26, 2024: Announce collaboration with General Motors and Rivian to develop a 100 MW solar project to power electric vehicle manufacturing. (Source: Exelon press release)

Duke Energy Corporation:

- Jan 24, 2024: Partner with Google to develop a 2 GW renewable energy project in North Carolina. (Source: Duke Energy press release)

Pacific Gas and Electric Company (PG&E):

- Jan 18, 2024: Announce plans to invest $10 billion in wildfire prevention and mitigation over the next five years. (Source: PG&E press release)

Southern Company:

- Jan 17, 2024: Partner with Microsoft to develop a carbon capture and storage project at a natural gas plant in Alabama. (Source: Southern Company press release)