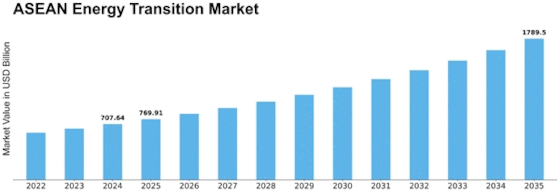

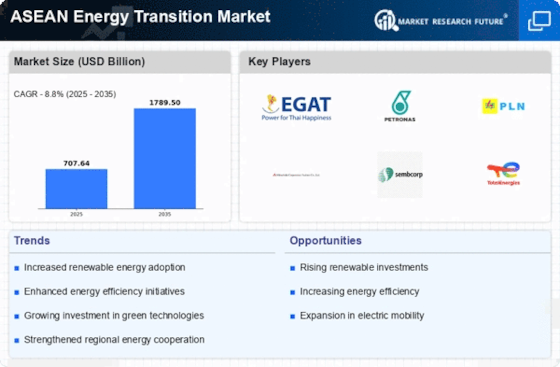

Asean Energy Transition Size

ASEAN energy transition market Growth Projections and Opportunities

The dynamics of the ASEAN energy transition market are determined by several factors that act cumulatively on this market within Southeast Asia. One of the main factors motivated by increasing emphasis on clean and sustainable energy solutions that form global consensus to fight climate change. The demographics of the market are directly linked to how goods and services within this region try moving away from reliant on fossil fuel toward low-carbon renewable energy. Policies and initiatives to fasten the energy transition are adopted by governments of ASEAN countries motivated for achieving sustainability purposes such as ensuring consistent supplies, preserving environmental factors in addition economic development. The factors that drive the ASEAN energy transition market and are hugely impacted by technological advancements in renewable energy technologies. New and historical developments in solar, wind, hydroelectricity among other renewable energy technologies advance the modern trends of region’s power industry. The factors are driven by the constant improvement that is done on renewable machines and systems with an objective of increasing efficiency, affordability as well as integration for a seamless transformation from conventional to sustainable sources. Government policies and regulatory frameworks are most essential in creating dynamics of the market for ASEAN energy transition. This is propagated by the development of renewable energy targets, feed-in tariffs, and incentives along with investor friendly regulatory support. An enabling environment for the renewable energy development is being established through a conducive atmosphere that attracts investments and builds joint ventures with private sector to effectively work towards achieving the goals of transition. Environmental issues and climate change also form part of the market drivers that are associated with ASEAN’s energy transition. As such, it is one of the most susceptible parts to climate change effects in terms high sea levels, storms among others. The dynamics are driven by the critical urge to minimize greenhouse gas emissions and curtail pollution as far as energy occurs. Renewable energy adoption contributes essential in solving this environmental threat and ensuring a sustainable future for every country that is part of the ASEAN. This is because costly investments in clean energy infrastructure and projects have significant effects on the market dynamics of ASEAN energy transition. The activity centers also vary by government, utility, and private investor decisions on allocating capital for renewable energy facilities, grid storage systems as well as smart power grids. The investments in the decentralized energy solutions, which include off-grid and mini grid systems have an influence on the total dynamics of market for transitioning to new forms or sources of energies. The market dynamics in the ASEAN energy transition are affected by energy security as well as diversifying sources of this form These dynamics are guided by the region’s mission to become less dependent on imported fossil fuels and promote energy resiliency through deployment of locally available renewable energy resources. The use of alternative types in the adoption of distributed energy systems, smart grids and energy storage technologies leads to more resilient as well as a secure deployment. There are global economic factors and geopolitical forces that drive the market dynamics of ASEAN energy transition. These dynamics are influenced by international alliances, partnerships, and investments in clean energy-related projects. The ASEAN region is increasingly serving as an epicenter for global clean energy investment and partnerships, commanding the principles of technology transfer dynamics in knowledge exchange collaborative efforts to fuel the revolution pace towards undergoing regional Energy Transition. Renewable energy sector competition and the fight among contemporary technology providers affect ASEAN market parameters of an energetic transition. These features comprise the dynamics of this market due to current business players, technological innovations and strategic alliances. Other factors that affect the market include collaborations and partnerships among ASEAN members, international organizations and private sector establishments which in their capacity affects competitiveness of energy transition projects within certain regions. In the ASEAN energy transition market, dynamic forces include technological developments; behavioral changes and government policies owing to environmental considerations as well investments aims related at improving energy security status of the region based on global economic conditions alongside competitive force within sector renewable energies. With ASEAN countries conducting their energy transition, the market is bound to change and present opportunities for sustainable development; economic growth, along with a cleaner and more adaptable energy system in an ever-changing interdependent Southeast Asian environment.

Leave a Comment