Market Share

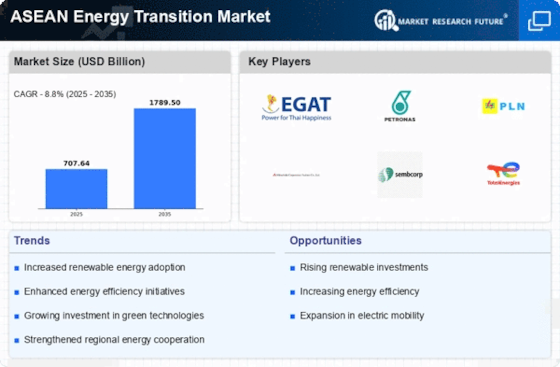

ASEAN energy transition market Share Analysis

To succeed in this rapidly changing environment of the ASEAN energy transition market, businesses need to have appropriate positioning strategies for their respective share markets that can help them survive and compensate with innovative trends within the sector while leaving behind rival companies. Such companies have designed Technology Innovation as one of the imperative strategies, and they invest in modern REN solutions, smart grid technologies, and energy storage systems. Companies that are implementing innovations including solar photovoltaic arrays, wind turbines and grid optimization technologies become the forerunners in offering sustainable solutions with superior efficiency to storage of energy leading to significant share capture and retention. The strategic collaborations and partnerships are also instrumental in creating a market share positioning within the ASEAN energy transition market. Companies aligning with government bodies, utilities or technology providers allows them to pool together resources and knowledge. Such partnerships improve implementation of the project, guarantee favourable regulatory support, and enable companies to become key players in regional energy transition providing opting market share within certain field. Compliance with strict environmental and regulatory criteria is an important strategic platform in the energy transition market of ASEAN. Firms that place emphasis on sustainability initiatives, undertake direct investments in low-carbon technologies and emphasize commitment to emission reduction targets stand favorably. Following regulations not only makes the marketplace relevant but also commands trust among various stakeholders, including investors and consumers whose choices are made based on specific regulation compliance which finally positively affect modern companies’ share of markets. Companies operating in the ASEAN energy transition market focus on diversification and optimization of their portfolios to attain superior market share positioning. By supplying a broad array of renewable energy options consisting of solar, wind hydropower, and bioenergy companies are able to address the various ways in which people utilize the vast amountsof powerin this area. Furthermore, the greater efficiency of energy storage and distribution systems brings to grid stability competitiveness optimizing whole market share. Strategic pricing is a crucial factor in market share positioning of the ASEAN energy transition market. Companies main showroom to strike an effective balance between competitive pricing, attractive government incentives and operational costs that will attract investment partners and customers. Enterprises that develop or provide competitive pricing structures, new financing models and bundled energy services thus acquire a market advantage by securing larger shares in the market. Other strategic pricing strategies may include long-term power purchase agreement and community focused price initiatives to advance the regional energy transition mission. Expansion geography and the deployment of projects in some important ASEAN countries is an opportunity that can gain a competitive market share as part of their strategies manipulation energy transition industry. When increasingly quickly Southeast Asian nations move to cleaner energy resources, companies that plan rationally increase their deal in rising markets or regions with vigorous renewable power targets could have new opportunities and a greater market share. Developing projects to suit different energy needs and legislative frameworks is an essential prerequisite for expanding into markets with varying demand in the ASEAN region. Investment in R&D plays a significant role under market share positioning strategies of the ASEAN energy transformation industry. The innovations in energy storage technology, grid integration solutions and hybrid renewable systems help corporations keep up with the trends of industry change and technological advancement. Being the market leaders in sustainable energy solutions creates companies as very significant actors in ASEAN’s energy transition, helping to allay investors’ concerns and increase their positive corporate image. The CRM and stakeholders’ engagement are strategic means to take a competitive market share in the ASEAN energy transition arena. Such collaboration and support necessitate developing effective working relationships with government bodies, local communities, project investors. Positive relationships with stakeholders are necessary for managing association fields, acquiring social license and attracting the investment sources that influence market share. Strategic acquisitions and mergers also determine how market players position themselves on the ASEAN energy transition market. When firms merge with related organizations, they enjoy emerging technologies and extended project assets as well because of broadening markets. These growth activities are aimed at empowering companies to fortify market presence, tighten available resources and establish their dominance in terms of influence on ASEAN’s energy transition for overall market share.

Leave a Comment