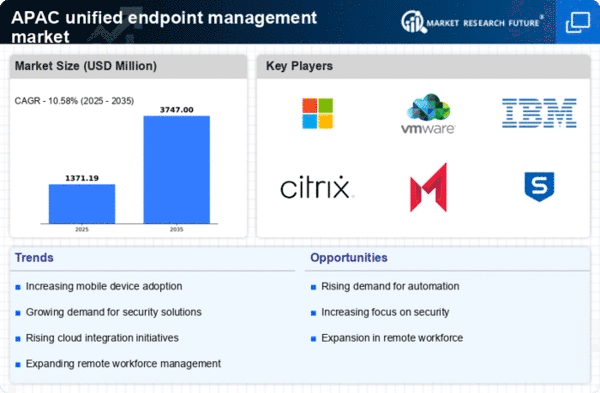

Growing Mobile Device Usage

The proliferation of mobile devices in APAC is a significant driver for the unified endpoint-management market. With an increasing number of employees utilizing smartphones and tablets for work purposes, organizations face challenges in managing and securing these devices. In 2025, it is estimated that mobile devices will account for over 50% of all endpoints in the corporate environment. This trend necessitates the implementation of unified endpoint-management solutions that can effectively manage diverse device types and operating systems. Companies are recognizing the need for comprehensive management strategies that encompass mobile devices, ensuring data security and compliance. As a result, the demand for unified endpoint-management solutions is likely to rise, as organizations seek to streamline their operations and enhance security across all endpoints. The growing reliance on mobile technology is thus a crucial factor driving the unified endpoint-management market.

Rising Cybersecurity Threats

The unified endpoint-management market in APAC is experiencing a surge in demand due to the increasing frequency and sophistication of cyber threats. Organizations are compelled to adopt comprehensive endpoint management solutions to safeguard their data and infrastructure. In 2025, it is estimated that cybercrime could cost businesses in APAC upwards of $1 trillion, highlighting the urgent need for robust security measures. This trend is driving investments in unified endpoint-management solutions, as companies seek to mitigate risks associated with data breaches and ransomware attacks. The focus on cybersecurity is not merely a reactive measure. It is becoming a strategic priority for organizations aiming to maintain customer trust and regulatory compliance. As a result, The unified endpoint-management market is likely to see accelerated growth. Businesses are prioritizing security features in their endpoint management strategies.

Adoption of Remote Work Policies

The shift towards remote work in APAC has significantly influenced the unified endpoint-management market. As organizations adapt to flexible work arrangements, the need for effective management of diverse endpoints has become paramount. In 2025, it is projected that remote work will account for approximately 30% of the workforce in major APAC economies. This transition necessitates solutions that can seamlessly manage devices across various locations while ensuring security and compliance. Unified endpoint-management solutions provide the necessary tools to monitor, secure, and manage endpoints, regardless of their physical location. Consequently, businesses are increasingly investing in these solutions to enhance productivity and maintain operational efficiency. The rise of remote work is thus a critical driver for the unified endpoint-management market, as organizations seek to empower their workforce while safeguarding sensitive information.

Regulatory Compliance Requirements

The unified endpoint-management market in APAC is significantly influenced by stringent regulatory compliance requirements. Governments across the region are implementing robust data protection laws, compelling organizations to adopt comprehensive endpoint management strategies. For instance, the Personal Data Protection Act (PDPA) in Singapore and similar regulations in other APAC countries mandate strict data handling and security protocols. As of 2025, non-compliance penalties can reach up to €20 million or 4% of annual global turnover, which poses a substantial risk for businesses. This regulatory landscape drives organizations to invest in unified endpoint-management solutions that ensure compliance with data protection standards. By integrating these solutions, companies can effectively manage their endpoints while adhering to legal requirements, thereby reducing the risk of financial penalties and reputational damage. The emphasis on compliance is thus a pivotal factor propelling the growth of the unified endpoint-management market.

Increased Investment in Digital Transformation

The unified endpoint-management market in APAC is benefiting from the heightened focus on digital transformation initiatives across various industries. Organizations are increasingly recognizing the importance of integrating technology into their operations to enhance efficiency and competitiveness. In 2025, it is projected that spending on digital transformation in APAC will exceed $500 billion, with a significant portion allocated to endpoint management solutions. This investment is driven by the need to modernize IT infrastructure and improve endpoint security. As businesses embark on their digital transformation journeys, they are likely to adopt unified endpoint-management solutions to streamline processes and ensure seamless integration of new technologies. This trend indicates a strong correlation between digital transformation efforts and the growth of the unified endpoint-management market, as organizations seek to leverage technology for improved operational outcomes.