Remote Work Trends

The shift towards remote work has significantly influenced the unified endpoint-management market. In the GCC, organizations are increasingly adopting flexible work arrangements, necessitating robust endpoint management solutions to support a distributed workforce. This trend has led to a projected growth rate of approximately 15% in the market by 2026. Companies are investing in technologies that enable secure access to corporate resources from various devices, ensuring productivity while maintaining security protocols. The need for seamless integration of personal and corporate devices into a unified management framework is becoming essential, thereby driving the demand for advanced endpoint management solutions in the region.

Integration of IoT Devices

The integration of Internet of Things (IoT) devices is a significant driver for the unified endpoint-management market.. In the GCC, the adoption of IoT technologies is accelerating, with industries such as healthcare, manufacturing, and smart cities leading the charge. This trend is expected to contribute to a market growth rate of approximately 18% by 2027. As organizations deploy more IoT devices, the complexity of managing these endpoints increases, necessitating advanced management solutions that can provide visibility and control. The unified endpoint-management market is thus poised to benefit from the growing need for comprehensive management strategies that encompass a wide range of connected devices.

Rising Cybersecurity Threats

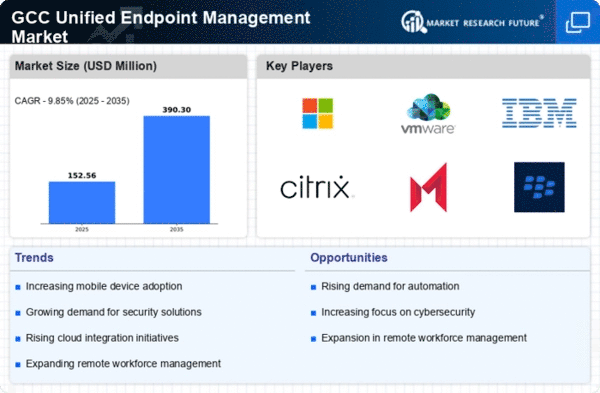

The unified endpoint-management market is experiencing a surge in demand due to the increasing frequency and sophistication of cyber threats. Organizations in the GCC are prioritizing the protection of their digital assets, leading to a heightened focus on endpoint security solutions. In 2025, it is estimated that cybercrime could cost businesses globally over $10 trillion annually, prompting GCC enterprises to invest in comprehensive endpoint management systems. These systems not only safeguard devices but also ensure compliance with regulatory standards, which is crucial in a region where data protection laws are becoming more stringent. As a result, the unified endpoint-management market is likely to see substantial growth as businesses seek to mitigate risks associated with cyber threats.

Increased Mobile Device Usage

The proliferation of mobile devices in the GCC is a key driver for the unified endpoint-management market. With an estimated 90% of the population using smartphones, organizations are compelled to manage a diverse array of devices effectively. This trend is leading to a projected market growth of around 12% annually as businesses seek solutions that can manage both mobile and traditional endpoints. The need for a unified approach to device management is becoming increasingly apparent, as companies aim to streamline operations while ensuring security across all platforms. Consequently, the unified endpoint-management market is likely to expand as organizations adapt to this mobile-centric environment.

Regulatory Compliance Requirements

The stringent regulatory compliance requirements in the GCC are propelling the unified endpoint-management market.. Governments are implementing laws that mandate data protection and privacy, compelling organizations to adopt comprehensive endpoint management strategies. For instance, the introduction of the Personal Data Protection Law in various GCC countries has necessitated that businesses ensure the security of personal data across all endpoints. This regulatory landscape is expected to drive market growth, as companies invest in solutions that not only meet compliance standards but also enhance their overall security posture. Thus, the unified endpoint-management market will benefit from these evolving legal frameworks..