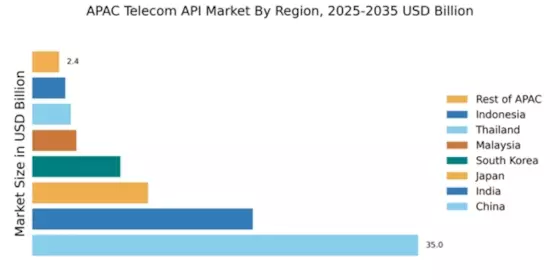

China : Unmatched Growth and Innovation

China holds a commanding 35.0% market share in the APAC telecom API sector, valued at approximately $1.5 billion. Key growth drivers include rapid digital transformation, increasing mobile penetration, and government initiatives promoting smart city projects. The demand for seamless communication solutions is rising, driven by e-commerce and fintech sectors. Regulatory support, such as the Cybersecurity Law, fosters a secure environment for API integration, while robust infrastructure development enhances connectivity.

India : A Booming Digital Economy

India captures a significant 20.0% of the APAC telecom API market, valued at around $800 million. The growth is fueled by a burgeoning digital economy, increasing smartphone adoption, and government initiatives like Digital India. Demand for APIs is surging in sectors such as e-commerce, healthcare, and education, driven by a young, tech-savvy population. Regulatory frameworks are evolving to support innovation while ensuring data privacy and security.

Japan : Innovation at the Forefront

Japan holds a 10.5% share of the APAC telecom API market, valued at approximately $450 million. The market is propelled by advancements in IoT and 5G technology, with a strong focus on automation and efficiency. Demand for APIs is particularly high in sectors like automotive and smart homes, supported by government initiatives promoting digital transformation. Regulatory policies encourage collaboration between telecom operators and tech firms, fostering innovation.

South Korea : Leading in Telecom Innovation

South Korea accounts for 8.0% of the APAC telecom API market, valued at about $350 million. The country is a leader in technology adoption, with a strong emphasis on 5G deployment and smart city initiatives. Demand for telecom APIs is driven by sectors such as gaming, e-commerce, and fintech. The competitive landscape features major players like SK Telecom and KT Corporation, supported by favorable regulatory policies that encourage innovation and investment.

Malaysia : Growth in Digital Services

Malaysia holds a 4.0% share of the APAC telecom API market, valued at approximately $160 million. The growth is driven by increasing smartphone penetration and government initiatives like the Malaysia Digital Economy Blueprint. Demand for APIs is rising in sectors such as e-commerce and logistics, supported by a growing startup ecosystem. Regulatory frameworks are evolving to enhance digital services while ensuring consumer protection.

Thailand : Digital Transformation Underway

Thailand captures 3.5% of the APAC telecom API market, valued at around $140 million. The market is experiencing steady growth due to increasing internet penetration and government initiatives promoting digital economy strategies. Demand for APIs is particularly strong in sectors like tourism and retail, with a focus on enhancing customer experiences. The competitive landscape includes local players and international firms, supported by regulatory policies that encourage innovation.

Indonesia : Expanding Digital Landscape

Indonesia holds a 3.0% share of the APAC telecom API market, valued at approximately $120 million. The growth is driven by rising mobile usage and government initiatives aimed at improving digital infrastructure. Demand for APIs is increasing in sectors such as e-commerce and fintech, reflecting the country's rapid digital transformation. The competitive landscape features both local and international players, with regulatory support fostering a conducive business environment.

Rest of APAC : Untapped Markets Awaiting Growth

The Rest of APAC accounts for 2.43% of the telecom API market, valued at around $100 million. This sub-region presents diverse opportunities, driven by varying levels of digital adoption and government initiatives across countries. Demand for APIs is emerging in sectors like agriculture and education, with local players beginning to establish a foothold. Regulatory environments are evolving, creating a favorable landscape for innovation and investment.